In the current fluctuating markets, investors are usually on the lookout of a compromise between the aggressive day trading and patience of long term investing. Swing trading provides those balances. Traders are able to make money by holding positions over a few days or weeks without having to track each tick by being aware of natural market swings. Swing trading coupled with a disciplined stock strategy is one of the most effective methods of increasing wealth in 2025.

Why Swing Trading is Effective?

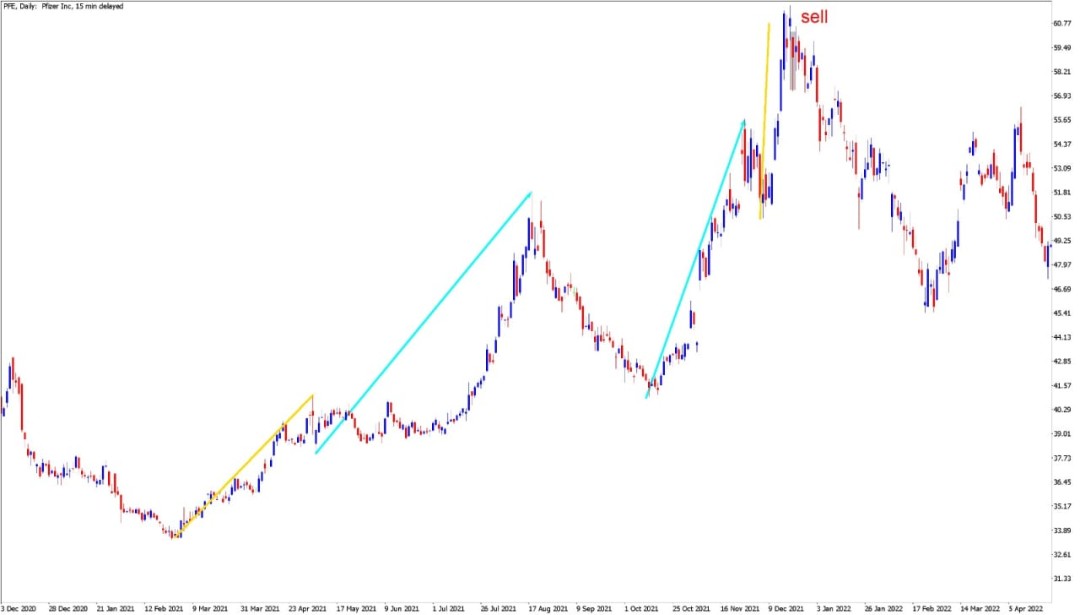

Markets oscillate stocks climb, stagnate and correct then resume a trend. Swing traders are looking to make money on such shorter moves as opposed to waiting years to make returns. Technical indicators, chart formations, and market sentiment give traders an opportunity to determine the entry and exit levels with high probability. The right stock approach guarantees consistency and control of risks during this process.

Best Swing Trading Strategies in 2025

1. Moving Average Crossovers

Two moving averages including short-term and long-term are used by traders. The crossing of the short-term above the long-term average tends to be an indication of a buying opportunity. A negative crossover implies selling.

Why it works: Assists in eliminating noise and identifying actual changes of trends.

2. Breakout Trading

This strategy is aimed at those stocks that pierced through a good resistance or support line with high trading volume. Breaking out early can be profitable due to rapid and intense returns.

Rationale behind its success: It takes advantage of the early momentum on new market trends.

3. Comedy and Drama Plays.

Swing traders usually purchase near past support level and sell near resistance level. This strategy does well in lateral or range markets.

Why it works:It utilizes well-defined price zones to maximize the ratio of risk and rewards.

4. RSI and Momentum Indicators

Relative Strength Index (RSI) assists traders to detect overbought (more than 70) and oversold (less than 30). Purchasing at over sold stages and selling at overbought stages can be very profitable.

Why it works:

Offers some knowledge on possible trend reversal.

5. Fibonacci Retracement Traders can determine in advance possible pullback levels in a trend by plotting retrace levels using Fibonacci ratios.

Why it is good: aids in perfecting points of entry and exit.

Risk Management: Support of every Stock Strategy.

The most superior swing trading strategies cannot work without the right risk management. Traders should:

Placing set stop-loss orders to defend capital.

Do not risk in excess of 1-2 percent of account balance on each trade.

Trade diversification in sectors and assets.

Stock discipline will guarantee survival in volatile markets.

Would Swing Trading Be of the greatest benefit to Who?

Swing trading is ideal for:

Individuals working in professions that involve minimal time on the screen.

Flexibility is desired by part-time traders.

Investors who like to study charts during the evenings or weekends.

It is a combination of active and patient attitude, so that is one of the most balanced strategies of traders of the modern era.

Final Thoughts

Swing trading will be one of the most viable approaches of active investors in 2025. Through the most effective swing trading tactics like breakout setups, moving averages, Fibonacci retracements the traders can take the advantage of the opportunity and also reduce the risks. Combining such approaches with a well-disciplined stock strategy will make them dependable and smarter in the long run.

Disclaimer: This press release may contain forward-looking statements. Forward-looking statements describe future expectations, plans, results, or strategies (including product offerings, regulatory plans and business plans) and may change without notice. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements.

Media Contact

Company Name: StockStrategy

Contact Person: Mohmed

Email: Send Email

City: London

Country: United Kingdom

Website: https://stockstrategy.net/