Over the past year, software and cybersecurity stocks have reclaimed Wall Street’s spotlight as businesses rush to secure cloud, AI, and identity environments, but not every vendor stands to benefit equally. Investors are hunting for platforms that can cross-sell, widen margins, and ride the next wave of enterprise spending.

One stock that just moved up on Wall Street Radar is Okta (OKTA). Recently, Jefferies upgraded the identity-management specialist to “Buy” and raised its price target, arguing that Okta can evolve into a full identity platform and that several FY-27 catalysts make its current valuation look stretched to the upside.

That bullish call, which came alongside Jefferies’ 2026 picks like Palo Alto (PANW) and Zscaler (ZS), helps explain the late-week bump in Okta shares and frames the central question for investors: Is now the time to buy?

About Okta Stock

Founded in 2009, Okta builds identity and access management software that helps organizations secure who can access what. Its cloud-based platform, from single sign-on and multifactor authentication to identity governance, protects employee accounts and the emerging wave of AI-driven agents, and thousands of customers rely on its tools.

Recently, Okta was named a Leader in Gartner’s 2025 Access Management Magic Quadrant, reaffirming its market position. It also rolled out key partnerships, for example, announcing an AWS IAM Identity Center integration to streamline access for AWS Partner Central users, which should broaden its enterprise reach.

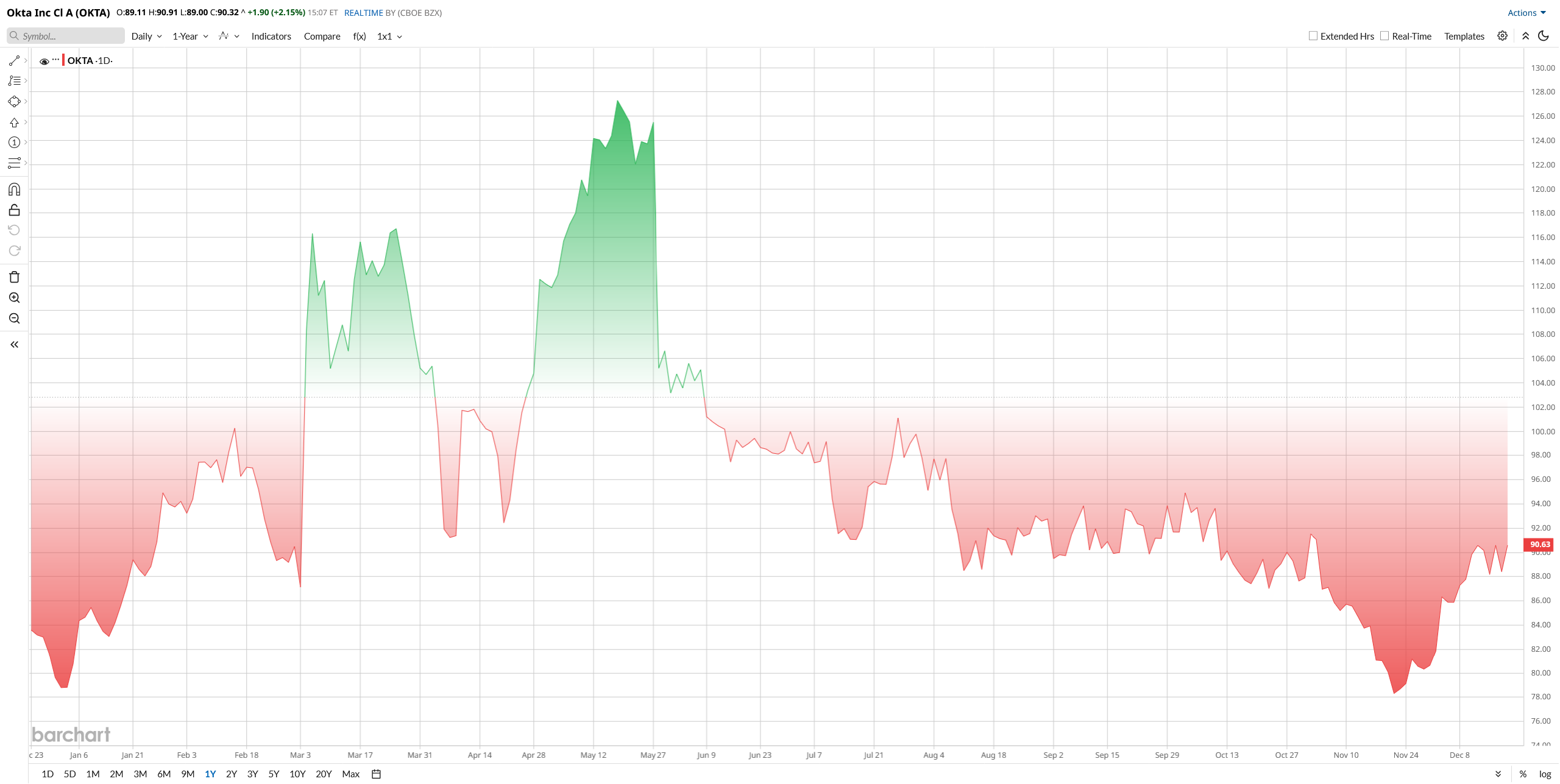

With a market value of nearly $15.6 billion, Okta stock has had quite a volatile year. The stock is up roughly 15% year-to-date (YTD) in 2025 after tumbling to a 52-week low of $75.05 in early December. The recovery comes on the heels of better execution, recent earnings beats, a firmer outlook, and growing recognition of Okta’s leadership in AI and cloud identity.

However, that optimism comes with a cautionary price tag. On trailing earnings, Okta trades near 80 times, roughly three times the sector median. Its price-to-sales ratio approaches 6x, well above typical software peers, and its enterprise-value-to-revenue multiple of about 5 leaves it richer than many SaaS rivals. Those lofty multiples mean investors are pricing in continued strong growth and little margin for missteps.

Okta Delivers Beat and Raise Quarter

Okta delivered a stronger-than-expected quarter. For Q3 fiscal year 2026, total revenue came in at $742 million, up 12% year-over-year (YoY), with subscription sales at $724 million, an 11% increase.

Profitability showed clear improvement, with net income rising to $43 million from $16 million a year earlier. Free cash flow was around $211 million, and the company finished the quarter with $2.463 billion in cash and short-term investments. CEO Todd McKinnon said Okta’s platform “secures AI” and expressed enthusiasm about carrying that momentum into the fourth quarter and beyond.

Management pushed guidance higher, forecasting Q4 revenue of $748 million to $750 million, roughly 10% growth, and EPS of $0.84 to $0.85. That raises full-year targets to about $2.906 billion to $2.908 billion in revenue and $3.43 to $3.44 in EPS, modestly above prior guidance and slightly ahead of consensus.

In short, Okta’s beat-and-raise quarter sets a high bar for 2026.

What Do Analysts Think About OKTA Stock?

Several Wall Street analysts have revised their price targets on Okta following its solid Q3 results. Jefferies upgraded OKTA stock to a “Buy” rating with a $125 target, citing its “significant opportunity” in identity security and AI.

On the other hand, Morgan Stanley maintained its “Overweight” rating but lowered its 12-month target to $110 from $123 after the earnings report.

Goldman Sachs also trimmed its target to $117 while keeping a “Buy” rating. Piper Sandler took a more cautious stance, cutting its target to $95 on concerns about slowing growth.

While sentiment remains constructive, some analysts caution that expectations are now elevated. Okta will need to turn recent momentum into stronger bookings growth to support the bullish outlook.

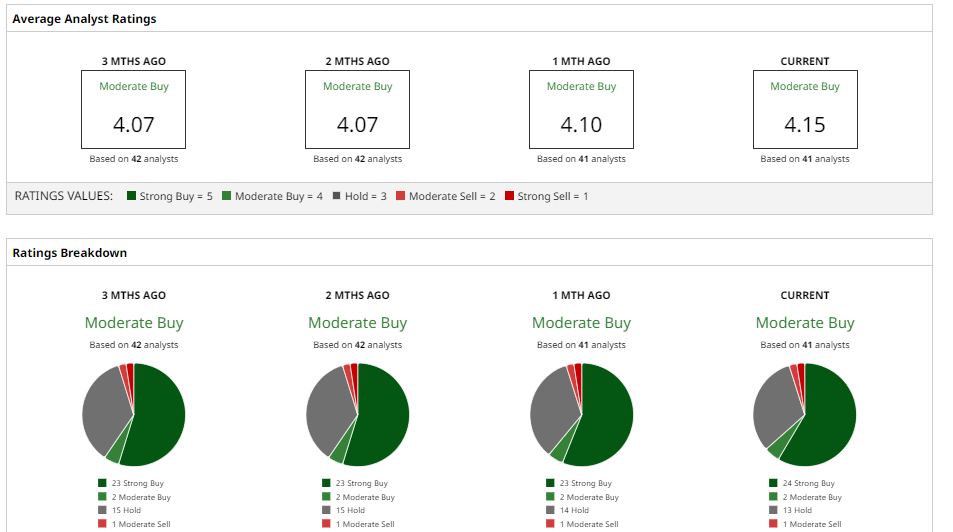

Overall, Wall Street views Okta’s leadership in identity security, particularly for AI and cloud environments, as a key growth driver. The consensus rating is “Moderate Buy,” with an average 12-month price target of $112, implying roughly 25% upside from current levels.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Analyst Just Raised Their Micron Stock Price Target by 50%. Should You Buy Shares Here?

- iRobot Just Filed for Bankruptcy. What Does That Mean for IRBT Stock? And Why Have Investors Been Chasing Shares Higher?

- Chip Stocks Are No Longer an Automatic Path to Profits. What the Numbers Say About This Key Semi ETF Now.

- As Robinhood Moves Into Sports Betting, Should You Buy, Sell, or Hold HOOD Stock?