CubeSmart (CUBE), a leading owner and operator in the U.S. self-storage sector, is gaining attention as it has just announced a 1.9% increase in its quarterly dividend to $0.53 per share, marking the company’s 16th consecutive annual dividend raise and signaling continued commitment to returning cash to shareholders.

CubeSmart is carving out its place as a dynamic player in the U.S. self-storage real estate investment trust (REIT) landscape by leaning into strategic expansion initiatives and diversified revenue streams amid mixed operational trends. The company continues to grow its footprint, with currently over 1,500 self-storage properties across the nation.

Does this combination of dividend stability and business expansion make CUBE stock a buy at current levels?

About CubeSmart Stock

CubeSmart is a self-administered and self-managed REIT focused on the ownership, operation, acquisition, and development of self-storage facilities across the country, serving both residential and commercial customers with climate-controlled and easily accessible storage solutions. Headquartered in Malvern, Pennsylvania, the company has grown into the U.S.'s third-largest self-storage operator. CubeSmart’s market cap sits around $8.2 billion.

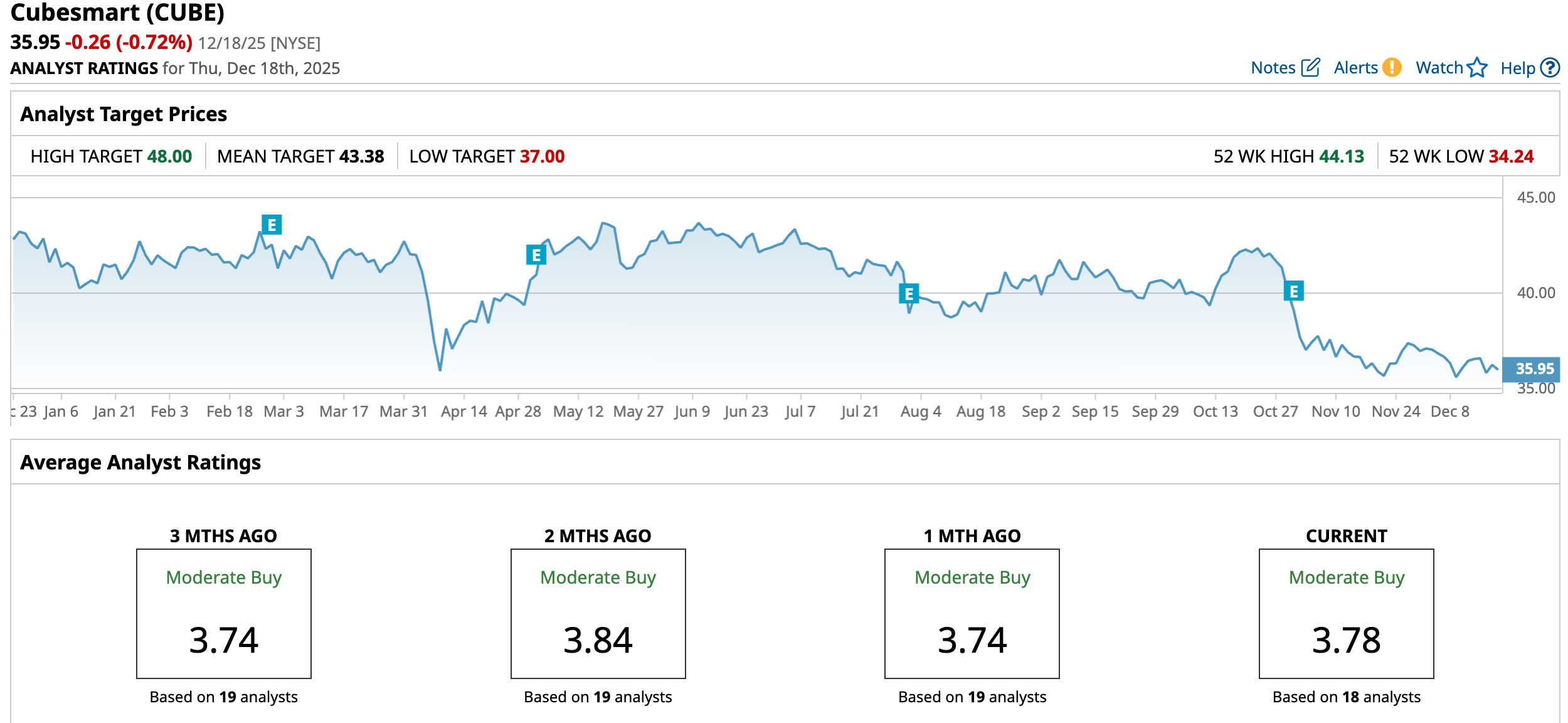

Over the past year, CUBE has underperformed broader benchmarks with a 17% decline, while its year-to-date (YTD) slump is around 16%, indicating continued downward pressure on the stock.

This lag has been driven by a combination of softness in same-store operating metrics, investor concerns around earnings quality and leverage, and broader market skepticism toward REITs amid rising interest rates and tighter credit conditions.

The stock is trading at a discount compared to industry peers at 13.81 times forward earnings.

While the stock has largely underperformed, CubeSmart’s dividend policy remains a core part of its appeal to income-oriented investors. The company has raised its quarterly dividend to $0.53 payable on Jan. 16, translating to an annualized payout of about $2.08, resulting in a current dividend yield of 5.70%, above the sector median. CubeSmart has a long history of consistent dividend increases, which underscores management’s commitment to returning capital to shareholders and provides a degree of confidence about future distributions.

However, it has a high payout ratio of 80.8%, which is typical for REITs given their distribution requirements, but also means there is less margin for error if operating fundamentals soften.

Mixed Q3 Performance

CubeSmart released its third quarter 2025 financial results on Oct. 30. The quarter presented a mixed picture compared with the year-ago period, with total revenues rising 5.2% year-over-year (YOY) to about $285.1 million.

However, same-store net operating income (NOI) declined 1.5% compared with Q3 2024, driven by a 1% drop in same-store revenues and a slight rise of 0.3% in operating expenses, while average same-store occupancy dipped to 89% versus roughly 90.2% a year earlier.

On the bottom line, earnings per share (EPS) fell to $0.36 from $0.44 in Q3 2024, and adjusted funds from operations (FFO) per share slipped 3% to $0.65 versus $0.67 in the prior-year quarter.

Despite these YOY headwinds in core operating metrics, CubeSmart highlighted positive trends and strategic progression, including the addition of 46 stores to its third-party management platform (bringing that total to 863), and the opening of a development property.

Furthermore, management is now projecting adjusted FFO per share of $2.56 to $2.60 and EPS of $1.46 to $1.50 for the year, underscoring modest improvement compared with prior guidance.

Analysts predict FFO per share to be around $2.59 for fiscal 2025, down 1.5% YOY, before surging by 1.9% annually to $2.64 in fiscal 2026.

What Do Analysts Expect for CubeSmart Stock?

Earlier this month, RBC Capital reiterated an “Outperform” rating on CubeSmart and set a $46 price target, while naming the self-storage REIT its “top idea for 2026.” The firm highlights CubeSmart’s urban-focused portfolio, particularly its strong New York City exposure as a key advantage, given favorable supply-demand dynamics and limited housing mobility.

However, last month, KeyBanc downgraded CubeSmart to “Sector Weight” from “Overweight,” citing concerns around the company’s growth outlook and broader challenges facing the self-storage sector.

While New York City remains a standout market, delivering solid same-store revenue growth, KeyBanc believes overall fundamentals remain constrained and expects CUBE to perform in line with the sector, prompting the more cautious stance despite the stock’s long dividend history and above-average yield.

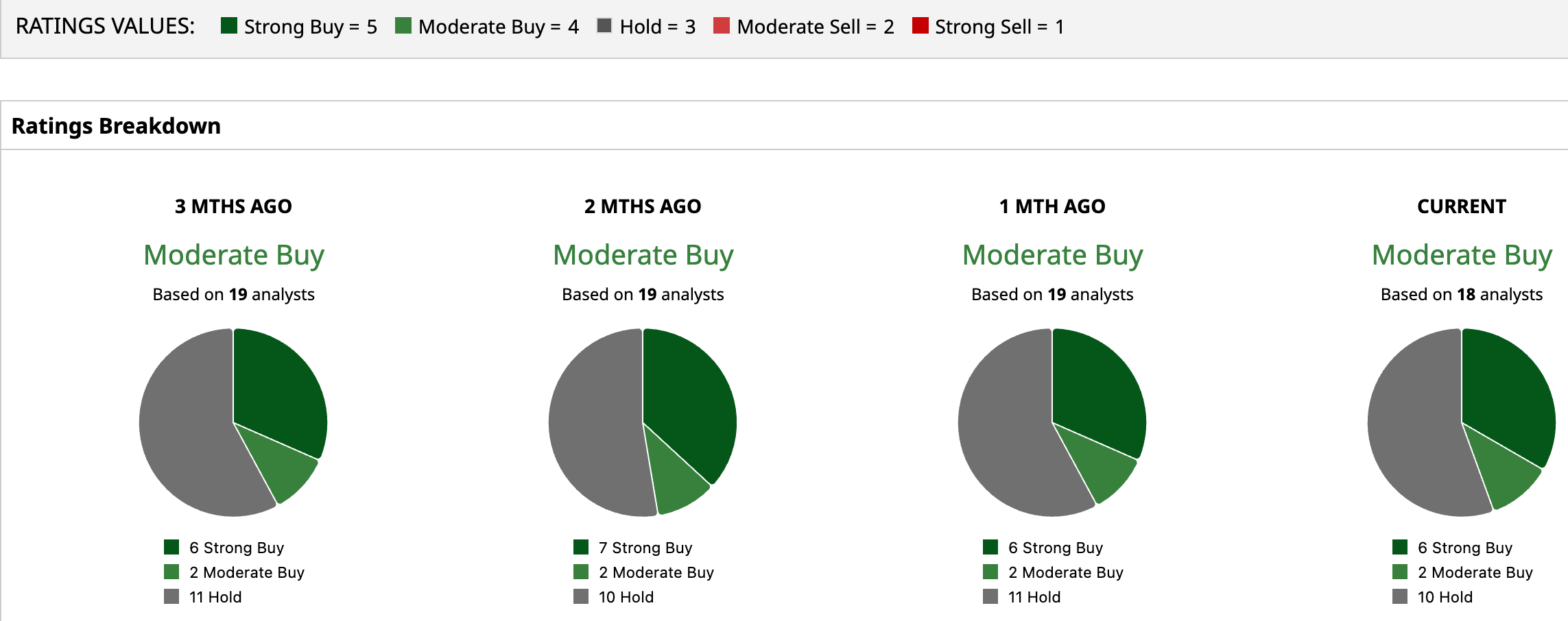

Overall, CUBE has a consensus “Moderate Buy” rating. Of the 18 analysts covering the stock, six advise a “Strong Buy,” two suggest a “Moderate Buy,” and the remaining 10 analysts are on the sidelines, giving it a “Hold” rating.

The average analyst price target for CUBE is $43.38, indicating a potential upside of 20.7%. The Street-high target price of $48 suggests that the stock could rally as much as 33.5%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Last Christmas, Alex Karp Was ‘Exceedingly Grateful’ for Palantir Stock Bulls Who Ignored Wall Street's ‘Rusty, Crusty Platitudes.’ How Did Palantirians Do in 2025?

- Coinbase Wants to Become Your New Choice for Stock Trading. Will Its Bold Bet Pay Off for COIN Stock?

- The Nasdaq-100 ETF Just Flashed a Bearish Chart Signal. Here’s What Happens Next.

- Dear Western Digital Stock Fans, Mark Your Calendars for Dec. 22