Joby Aviation (JOBY) is a California-based aviation company developing electric vertical takeoff and landing (eVTOL) aircraft for use as air taxis. Its aircraft are designed to be quiet, all‑electric, and capable of carrying several passengers at speeds up to about 200 mph for close to 150 miles, aiming to reduce urban congestion and emissions through aerial ridesharing.

Founded in 2009, Joby Aviation is headquartered in Santa Cruz, California, with additional facilities in Marina and San Carlos, California. The company primarily operates and tests in the United States but is positioning its technology for future international deployment as urban air mobility infrastructure and regulations develop globally.

Joby to Double Production

Joby Aviation recently announced plans to double its U.S. manufacturing capacity, targeting four aircraft per month by 2027 to accelerate eVTOL production. The expansion will leverage facilities in California and Ohio.

This follows the May 2025 close of a $250 million initial tranche from Toyota (TM). The partners are now finalizing a strategic manufacturing alliance to support the production ramp-up.

About JOBY Stock

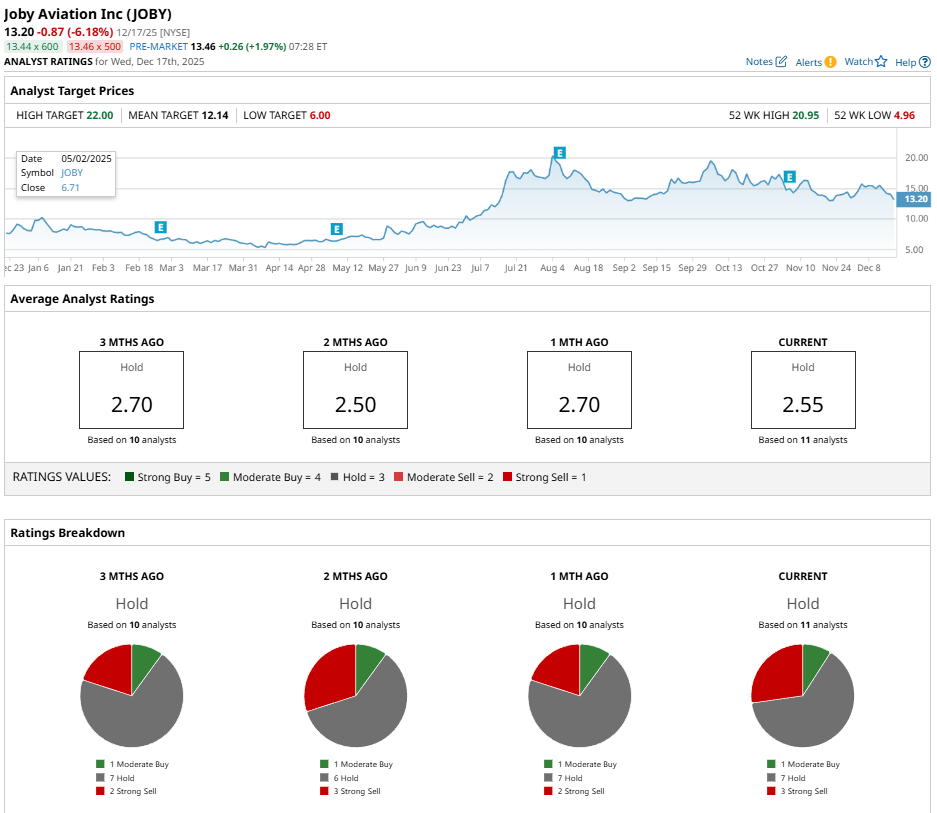

Following a run-up earlier in 2025, Joby Aviation trades well above its 52‑week low of $4.96 but below its high of $20.95. Over the last five days, the stock has declined by approximately 11%, and it is down about 5% over the past three months, as profit-taking and a discounted equity offering have weighed on sentiment.

Despite recent pullbacks, Joby is still up more than 70% over the past year and 50% in the past six months, outperforming major indices over the same period. The shares trade above the 200-day moving average but below the 50-day moving average, reflecting strong long-term momentum but near-term consolidation with elevated volatility compared to the small-cap index.

Joby Aviation’s Q3 Results

Joby Aviation reported Q3 2025 revenue of $23 million, including $14 million from the recent Blade acquisition and $9 million from defense contracts and engineering services. GAAP earnings per share (EPS) came in at -$0.48, missing analyst consensus estimates of -$0.19, amid a widened net loss of $401 million driven by $229 million in non-cash warrant and earnout revaluations tied to share price gains.

Operating expenses rose to $204 million, up $36 million quarter-over-quarter from Blade integration, staffing growth, and manufacturing investments, yielding an adjusted EBITDA loss of $133 million. Cash and short-term investments stood strong at $978 million at quarter-end, bolstered by $101 million from ATM sales and $33 million from warrant exercises, with $147 million in cash use mainly for capital expenditures and working capital. Meanwhile, October's $576 million equity raise further extends the runway.

Joby reaffirmed full-year 2025 cash-use guidance at the upper end of $500–540 million, incorporating Blade impacts, but provided no specific Q4 revenue outlook amid seasonal dynamics. Management emphasized certification progress, Dubai ramp, and defense demos as 2026 catalysts ahead of its commercial air taxi launch.

Should You Buy JOBY For 2026?

The stock’s recent performance on Wall Street echoes analyst sentiments. The consensus “Hold” rating with a mean price target of $12.14, reflects downside potential from the market rate.

The stock has been reviewed by 11 analysts, receiving one “Moderate Buy” rating, seven “Hold” ratings, and three “Strong Sell” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 1 Analyst Is Betting on 73% Upside Potential for D-Wave Quantum Stock. Should You Buy QBTS Shares Here?

- This 1 Lesser-Known Stock Is Set to Dominate with Nvidia and Broadcom in 2026

- This Flying Car Stock Just Announced a Major Production Update. Should You Buy Shares for 2026?

- How to Turn the Volatility in Tesla Stock into a 20% Upside Opportunity with Just 0.3% Downside Risk