With a healthy yield of 3.31%, ConocoPhillips (COP) is one of the most well-oiled dividend growth machines on the market. Not only does it continue to generate strong cash flow, with a strong focus on rewarding shareholders with buybacks and dividends, but it’s also well-positioned for multi-year dividend compound annual growth. That’s according to Wells Fargo analyst Sam Margolin, who argues that ConocoPhillips’ cash flow and yield will improve thanks to multiple catalysts.

The Key Catalysts for ConocoPhillips’ Dividend Growth

One of the key catalysts is the company’s Willow Project in Alaska, which is expected to start in 2029 and deliver about 180,000 barrels of oil per day at its peak. That should help fuel $4 billion of free cash flow inflection by 2029 and serve as a major boost to the company. It’s also targeting about $14 billion of free cash flow in a $70 oil price environment in 2029. Two, the analyst argues that the company’s free cash flow is expected to grow, which will allow it to increase dividends over the coming years. Growth will be driven by:

- The end of its capital commitment on the Qatar LNG project. The company is now 80% complete with the total LNG project capital.

- The start of new projects, especially Qatar LNG and Port Arthur LNG.

- The Port Arthur project should pay dividends, which will help fund share buybacks and reduce the overall dividend load.

Three, as noted in the company’s last earnings release, the company expects to “lower capital and operating costs with flat to modest production growth. Willow's total project capital is updated to $8.5 to $9 billion, with total LNG project capital reduced to $3.4 billion. Powered by our deep, durable, and diverse portfolio, we remain on track to deliver an expected $7 billion in incremental free cash flow by 2029, including $1 billion each year from 2026 through 2028.”

We should also note that in the first half of 2025, the company had a 46% payout rate, with about $4.69 billion spent on buybacks ($2.722 billion) and dividends ($1.968 billion). In the third quarter, it delivered $2.2 billion to shareholders, including $1.3 billion in buybacks and $1 billion in dividends. For the fourth quarter, it raised its dividend by 8% to 84 cents per share.

In short, COP remains one of the most well-oiled dividend growth machines on the market. That shouldn’t change any time soon.

Earnings Have Been Strong

While we wait for its next batch of earnings on Feb. 5, let’s take a look back at Q3. In the quarter, profits fell to $1.7 billion, or $1.38 per share, from $2.1 billion, or $1.78 per share, year-over-year (YoY). Q3 adjusted EPS of $1.61 beat estimates of $1.41. Q3 production jumped 25% YoY to 2.4 million barrels of oil per day. For 2026, it’s targeting $12 billion in capital spending, $10.2 billion in operating costs, and flat to 2% production growth as it advances the project in Alaska’s Willow project.

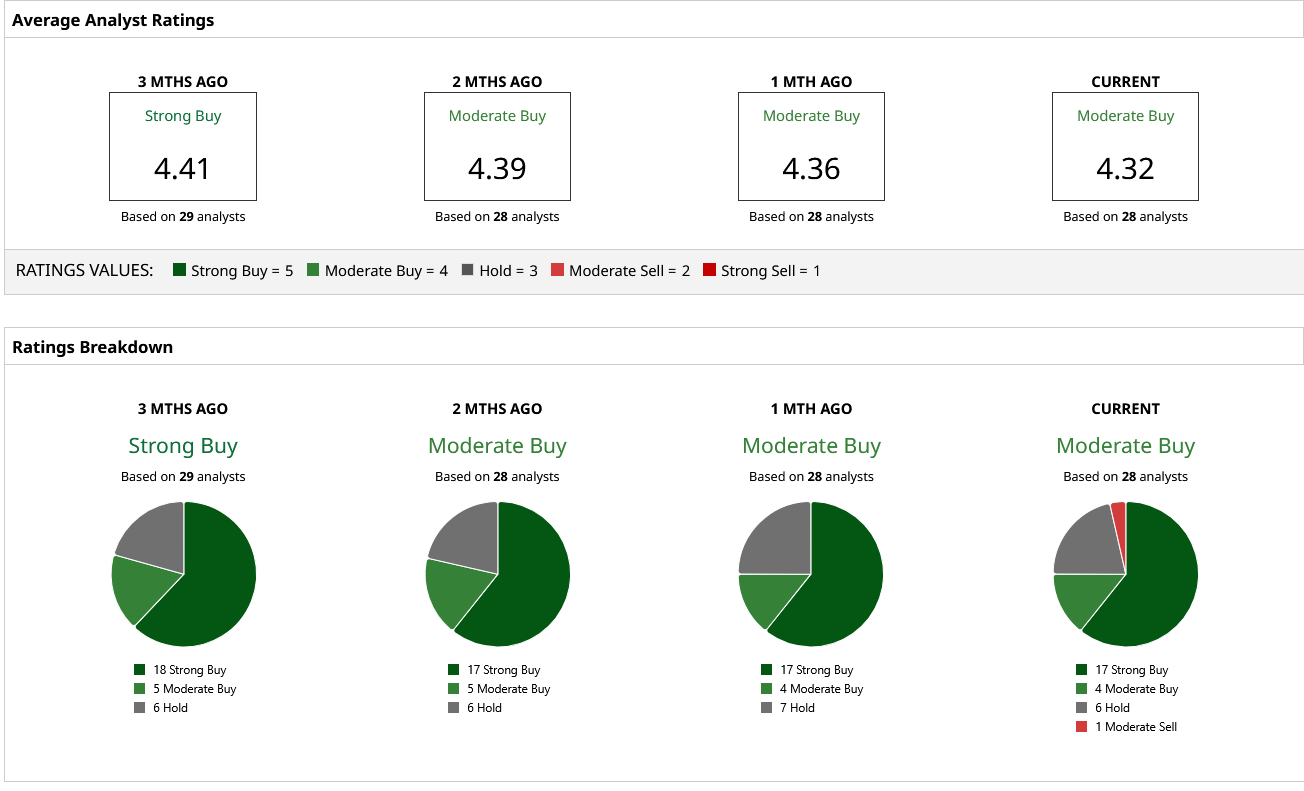

Overall, COP stock has a “Strong Buy” rating among 28 analysts. Of those, 17 have a “Strong Buy” rating, four have a “Moderate Buy” rating, six have a “Hold” rating, and one has a “Moderate Sell” rating. Presently, COP has a mean price target of $113.37. The high target is $132 from its current price of $103.41.

On the date of publication, Ian Cooper did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Analysts Think This Dividend Stock Is Headed for Big Payout Growth Ahead

- What Company Is Ryan Cohen Eyeing for a GameStop Megadeal? And Should You Buy GME Stock Here?

- 2 High-Risk, High-Reward Quantum Computing Stocks to Buy Now

- Here’s What Options Traders Expect from Advanced Micro Devices Stock After Earnings