Boasting a robust market cap of $1 trillion, Berkshire Hathaway Inc. (BRK.B) is a diversified multinational conglomerate based in Omaha, Nebraska. The company is led by legendary investor Warren Buffett and operates through a diversified portfolio of wholly owned businesses and equity investments.

The company's shares have lagged behind the broader market over the past 52 weeks. BRK.B stock has risen 4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 15.5%. Moreover, shares of the company are down 3.1% on a YTD basis, compared to SPX’s 1.9% gain.

In addition, shares of Berkshire Hathaway have also underperformed the State Street Financial Select Sector SPDR Fund’s (XLF) 5% return over the past 52 weeks and 1.4% drop in 2026.

Berkshire Hathaway has lagged the broader market over the past year, primarily because it has less exposure to high-growth sectors such as technology and AI, which have driven recent market gains. Its large cash reserves have also limited returns compared with fully invested peers, while several of its value-oriented businesses have underperformed growth stocks. In addition, investor uncertainty around long-term leadership succession beyond Warren Buffett has also weighed on sentiment.

For FY2025 that ended in December 2025, analysts expect Berkshire Hathaway’s EPS to drop 5.1% year-over-year to $20.89. The company’s earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

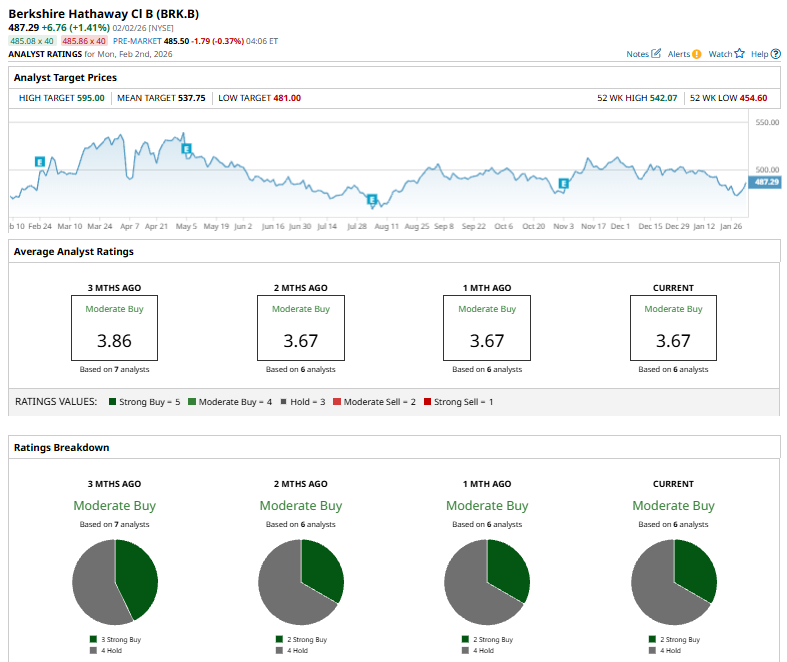

Among the six analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on two “Strong Buy” ratings and four “Holds.”

This configuration is slightly more bullish than it was three months ago, when BRK.B had three “Strong Buys” in total.

On November 3, UBS analyst Brian Meredith reaffirmed a “Buy” rating on Berkshire Hathaway and raised the price target to $595 from $593, reflecting continued confidence in the company’s valuation and growth prospects.

The mean price target of $537.75 represents a 10.4% premium to BRK.B’s current price levels. The Street-high price target of $595 suggests a 22.1% potential upside.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart