- Global Provider of Marine Fuel Solutions with Expanding Presence in Major Shipping Hubs with Offices in Singapore, Seoul, Dubai, and Shanghai.

- Customer-Centric, Compliant and Reliable Fuel Solutions Across Global Markets and Time Zones, Offering Customers 24/7 Operational Support Year-Round.

- European Expansion with New Office in Limassol, Cyprus to Strengthen Global Operations.

- Strong Operational Performance Driving Revenue and Gross Profit Growth Demonstrated in 2025 Interim Financial Results.

- $US114.6 Million in Revenues for Six Months Ended June 30th, Up 54% From Same Period Last Year.

- Received ISCC EU and ISCC PLUS Certifications from the International Sustainability and Carbon Certification.

- Establishment of Uni-Fuels Middle East FZCO, a Wholly Owned Subsidiary, in the United Arab Emirates and the Opening of a New Office in Dubai.

- Opening of a New Office in Shanghai Reinforcing the UFG Commitment to Strengthening its Asian Market Presence.

- Completed Company’s First-Ever Commercial Paper Issuance, Raising US$3 Million Through ADDX Exchange.

- Successfully Closed 3M USD Commercial Paper Series 002 on the ADDX Exchange Which Raised US$3 Million in Gross Proceeds.

- $3M USD Commercial Paper Series 001 Fully Repaid on October 17th. Singapore Closed its 3M USD Commercial Paper Series 002 Raising US$3 Million Gross.

- For 6 Months Ended June 30th Transaction Volumes Surged 75% Period-Over-Period to 502, Up from 287 in the Prior-Year Period.

- Total Fuel Deliveries Increased by 90% to Approximately 217,000 Metric Tons, Compared with Approximately 114,000 Metric Tons a Year Earlier.

- Supplied Fuels to 359 Vessels, Representing an 80% Increase from 200 Vessels in the Same Period Last Year.

- Operations Expanded to 103 Ports, Representing a 98% Increase from 52 Ports a Year Ago.

- Strengthened Customer Base, Serving 179 Customers, an Increase of 106% from 87 Customers in the Prior-Year Period.

Uni-Fuels Limited (Nasdaq: UFG) is a fast-growing global provider of marine fuel solutions with an expanding presence across major shipping hubs with offices in Singapore, Seoul, Dubai, and Shanghai. Established in 2021, UFG has evolved into a dynamic, forward-thinking company. UFG delivers customer-centric, compliant, and reliable fuel solutions across global markets and time zones, offering customers 24/7 operational support year-round. Backed by a thriving team of over 30 employees from diverse backgrounds and an extensive global supply network, UFG has forged trusted partnerships with customers, supporting them in achieving their operational objectives and decarbonization goals amid a robust industry-wide energy transformation.

New Office in Limassol, Cyprus to Strengthen Global Operations

On November 11th UFG announced the opening of its new office in Limassol, Cyprus. This strategic foray underscores the UFG commitment to expanding its international footprint and connecting with customers across the European markets.

The Limassol office, first for the Company in Europe, alongside offices in Dubai and Shanghai, which also started operations this year, marks a pivotal milestone in the UFG ongoing global expansion. UFG is doubling down on its efforts to provide localized expertise and enhance operational agility to synergize efficient operations beyond its current bases and offer customers reliable fuel delivery across high-demand corridors.

The UFG presence in Limassol fosters timely access to fuel price variations, regulatory updates, and supply chain shifts. With a finger on the pulse of local price signals, inventory trends, UFG can sharpen its pricing strategy accordingly to provide customers with more flexible procurement options and solutions tailored to their needs.

Cyprus serves as a gateway between traditional fuel markets and the green shipping corridor with a focus on driving renewable solutions. UFG, which is certified to provide alternative fuels, can coordinate low-emission fuel sourcing strategies that meet emerging demands, aligned with environmental regulations and sustainability targets.

2025 Interim Financial Results Deliver Strong Operational Performance Driving Revenue and Gross Profit Growth

On October 28th UFG announced its interim financial results for the six months ended June 30, 2025.

Key Strategic Developments

On February 12, 2025, UFG wholly owned subsidiary, Uni-Fuels Pte Ltd, received ISCC EU and ISCC PLUS certifications from the International Sustainability and Carbon Certification (“ISCC”). The ISCC certifications ensure that the biofuels traded by Uni-Fuels Singapore meet the requirements of the European Union’s (“EU”) Renewable Energy Directive (“RED II”), including the provision of Proof of Sustainability (“POS”).

On April 2, 2025, UFG, as part of its global expansion strategy, announced the establishment of Uni-Fuels Middle East FZCO (“Uni-Fuels Dubai”), a wholly owned subsidiary, in the United Arab Emirates and the opening of a new office in Dubai.

On June 30, 2025, UFG announced the opening of a new office in Shanghai. The formation of the wholly owned subsidiary, Uni-Fuels (Shanghai) Co Ltd, reinforces the UFG commitment to strengthening its Asian market presence.

On July 21, 2025, UFG announced Uni-Fuels Singapore has successfully completed the Company’s first-ever commercial paper issuance, raising US$3 million through ADDX Exchange, a private market platform regulated by the Monetary Authority of Singapore.

The UFG 3M USD Commercial Paper Series 001 has since been fully repaid on October 17, 2025. Subsequently, UFG announced that Uni-Fuels Singapore has successfully closed its 3M USD Commercial Paper Series 002 on the ADDX Exchange, and that it has raised US$3 million in gross proceeds. The Series 002 tokens were listed on the ADDX Exchange on October 18, 2025. Through the issuance of the CPs, UFG seeks to reinforce its liquidity position and enhance its capital structure, positioning it to pursue new growth opportunities. Both the offerings were oversubscribed, reflecting strong demand from accredited investors.

Key Operational Highlights

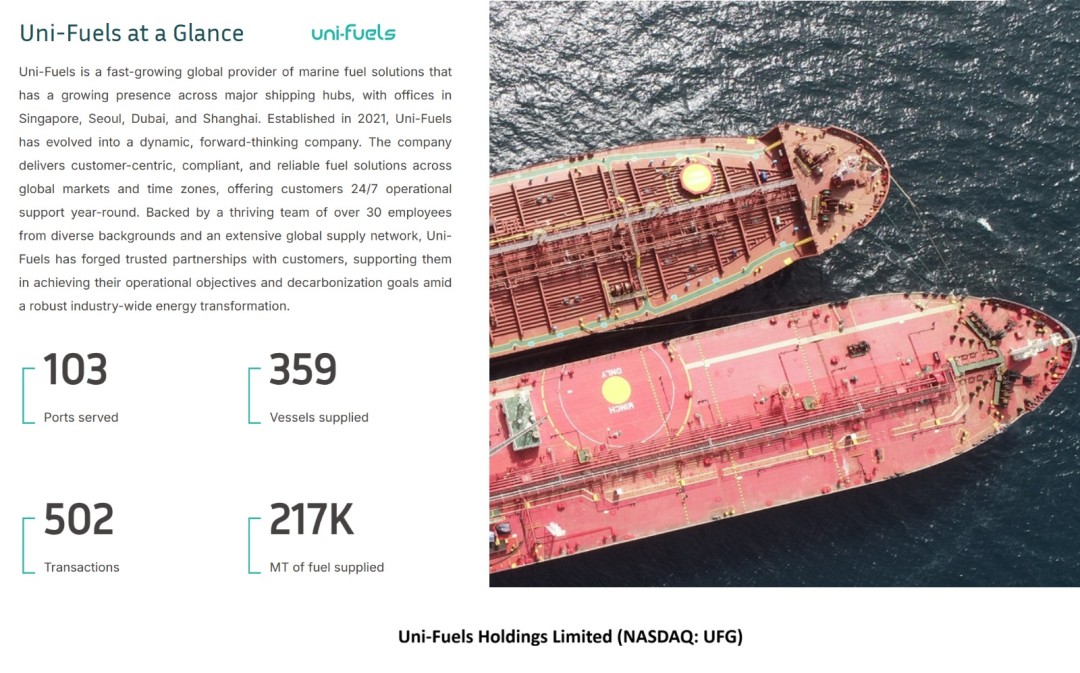

During the six months ended June 30, 2025, the UFG marine fuels business delivered strong momentum.

Transaction volumes surged 75% period-over-period to 502, up from 287 in the prior-year period.

Total marine fuel deliveries increased by 90% to approximately 217,000 metric tons, compared with approximately 114,000 metric tons a year earlier.

UFG supplied marine fuels to 359 vessels, representing an 80% increase from 200 vessels in the same period last year.

Operations expanded to 103 ports, representing a 98% increase from 52 ports a year ago, reflecting broader global coverage and customer reach.

UFG strengthened its customer base, serving 179 customers, an increase of 106% from 87 customers in the prior-year period.

Key Financial Highlights

For the six months ended June 30, 2025, UFG achieved strong financial performance across its marine fuels business.

Total revenues increased to approximately US$114.6 million, up approximately US$40.4 million or 54% period-over-period from US$74.2 million in the same period last year, reflecting stronger sales momentum across key markets and expanded business activities.

UFG gross profit improved to approximately US$2.1 million, up approximately US$0.6 million or 42% period-over-period from US$1.5 million, supported by increased sales volumes and operational efficiencies in the marine fuels business.

UFG Net income before tax was approximately US$0.2 million, an increase of approximately US$0.1 million or 73% period-over-period from US$0.1 million, reflecting the combined impact of higher revenues, increased cost of sales, and growth-related operating expenses.

Management Commentary

“The Company has continued its growth trajectory during the first half of 2025, characterized by incremental revenue growth despite a confluence of challenges in an uncertain economic climate. This is a testament to our commitment to creating greater shareholder value. We are executing our strategic priorities and broad growth roadmap effectively. As part of our global expansion plan, we have increased our geographical presence, spanning Dubai and Shanghai. Our strategic capital raises will further augment our liquidity position and enable the next phase of our expansion plan,” underlined Koh Kuan Hua, Chairman & CEO of UFG.

For more information on $UFG visit: www.uni-fuels.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Media Contact

Company Name: Uni-Fuels Holdings Limited (Nasdaq: UFG)

Contact Person: Koh Kuan Hua, Chairman & CEO

Email: Send Email

Phone: +65 6027 1250

Address:15 Beach Road Beach Centre #05-07

City: 189677 Singapore

Country: Singapore

Website: www.uni-fuels.com