The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how data & business process services stocks fared in Q3, starting with CSG (NASDAQ:CSGS).

A combination of increasing reliance on data and analytics across various industries and the desire for cost efficiency through outsourcing could mean that companies in this space gain. As functions such as payroll, HR, and credit risk assessment rely on more digitization, key players in the data & business process services industry could be increased demand. On the other hand, the sector faces headwinds from growing regulatory scrutiny on data privacy and security, with laws like GDPR and evolving U.S. regulations potentially limiting data collection and monetization strategies. Additionally, rising cyber threats pose risks to firms handling sensitive personal and financial information, creating outsized headline risk when things go wrong in this area.

The 9 data & business process services stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 1.4% while next quarter’s revenue guidance was in line.

While some data & business process services stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 4.6% since the latest earnings results.

CSG (NASDAQ:CSGS)

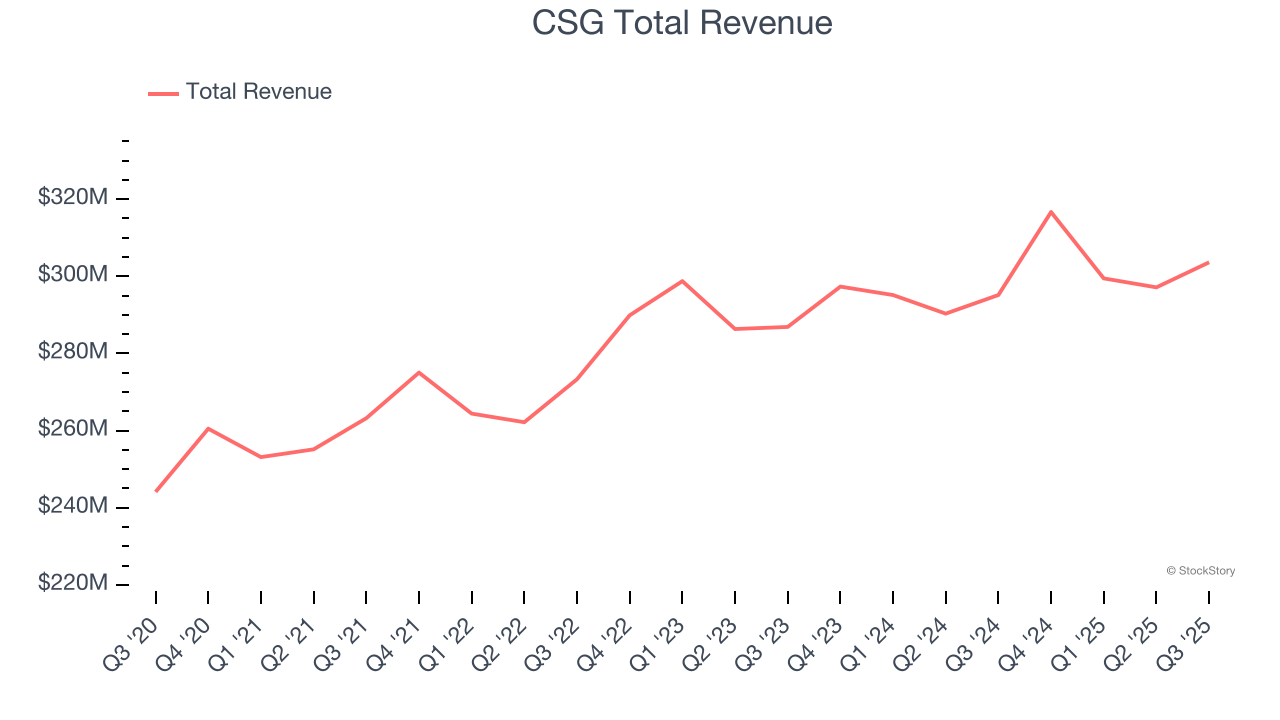

Powering billions of critical customer interactions annually, CSG Systems (NASDAQ:CSGS) provides cloud-based software platforms that help companies manage customer interactions, process payments, and monetize their services.

CSG reported revenues of $303.6 million, up 2.9% year on year. This print was in line with analysts’ expectations, and overall, it was a very strong quarter for the company with a beat of analysts’ EPS estimates.

CSG delivered the slowest revenue growth of the whole group. The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $77.88.

Is now the time to buy CSG? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q3: Broadridge (NYSE:BR)

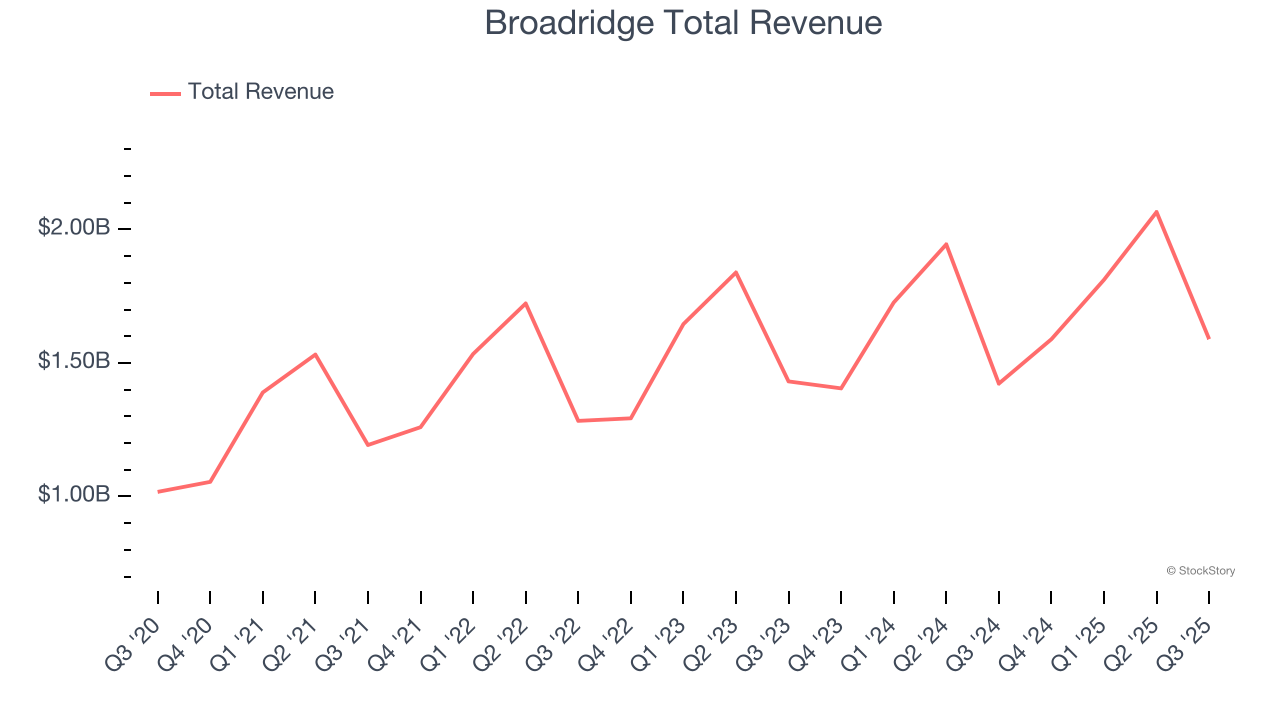

Processing over $10 trillion in equity and fixed income trades daily and managing proxy voting for over 800 million equity positions, Broadridge Financial Solutions (NYSE:BR) provides technology-driven solutions that power investing, governance, and communications for banks, broker-dealers, asset managers, and public companies.

Broadridge reported revenues of $1.59 billion, up 11.7% year on year, outperforming analysts’ expectations by 3.4%. The business had a stunning quarter with a beat of analysts’ EPS estimates and revenue guidance for next quarter exceeding analysts’ expectations.

Broadridge achieved the biggest analyst estimates beat among its peers. However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $223.16.

Is now the time to buy Broadridge? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Verisk (NASDAQ:VRSK)

Processing over 2.8 billion insurance transaction records annually through one of the world's largest private databases, Verisk Analytics (NASDAQ:VRSK) provides data, analytics, and technology solutions that help insurance companies assess risk, detect fraud, and make better business decisions.

Verisk reported revenues of $768.3 million, up 5.9% year on year, falling short of analysts’ expectations by 1.1%. It was a slower quarter as it posted full-year revenue guidance missing analysts’ expectations and a slight miss of analysts’ revenue estimates.

Verisk delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 8.1% since the results and currently trades at $213.36.

Read our full analysis of Verisk’s results here.

ADP (NASDAQ:ADP)

Processing one out of every six paychecks in the United States, ADP (NASDAQ:ADP) provides cloud-based human capital management solutions that help businesses manage payroll, benefits, talent acquisition, and HR administration.

ADP reported revenues of $5.18 billion, up 7.1% year on year. This result topped analysts’ expectations by 0.9%. Aside from that, it was a mixed quarter as it also logged a narrow beat of analysts’ revenue estimates but revenue guidance for next quarter meeting analysts’ expectations.

The stock is down 9.3% since reporting and currently trades at $253.74.

Read our full, actionable report on ADP here, it’s free for active Edge members.

SS&C (NASDAQ:SSNC)

Founded in 1986 as a bridge between technology and financial services, SS&C Technologies (NASDAQ:SSNC) provides software and software-enabled services that help financial firms and healthcare organizations automate complex business processes.

SS&C reported revenues of $1.57 billion, up 6.9% year on year. This print surpassed analysts’ expectations by 1.3%. Zooming out, it was a mixed quarter as it also produced a beat of analysts’ EPS estimates but a miss of analysts’ billings estimates.

SS&C had the weakest full-year guidance update among its peers. The stock is up 2.9% since reporting and currently trades at $83.20.

Read our full, actionable report on SS&C here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.