Cybersecurity platform provider CrowdStrike (NASDAQ:CRWD) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 22.2% year on year to $1.23 billion. The company expects next quarter’s revenue to be around $1.30 billion, close to analysts’ estimates. Its non-GAAP profit of $0.96 per share was 2% above analysts’ consensus estimates.

Is now the time to buy CrowdStrike? Find out by accessing our full research report, it’s free for active Edge members.

CrowdStrike (CRWD) Q3 CY2025 Highlights:

- Revenue: $1.23 billion vs analyst estimates of $1.22 billion (22.2% year-on-year growth, 1.6% beat)

- Adjusted EPS: $0.96 vs analyst estimates of $0.94 (2% beat)

- Adjusted Operating Income: $264.6 million vs analyst estimates of $260.7 million (21.4% margin, 1.5% beat)

- Revenue Guidance for Q4 CY2025 is $1.30 billion at the midpoint, roughly in line with what analysts were expecting

- Management raised its full-year Adjusted EPS guidance to $3.71 at the midpoint, a 1.4% increase

- Operating Margin: -5.6%, in line with the same quarter last year

- Free Cash Flow Margin: 24%, similar to the previous quarter

- Annual Recurring Revenue: $4.92 billion vs analyst estimates of $4.89 billion (22.5% year-on-year growth, 0.5% beat)

- Market Capitalization: $126.5 billion

Company Overview

Known for detecting the massive SolarWinds hack in 2020 that compromised numerous government agencies, CrowdStrike (NASDAQ:CRWD) provides cloud-based cybersecurity solutions that protect endpoints, cloud workloads, identity, and data through its Falcon platform.

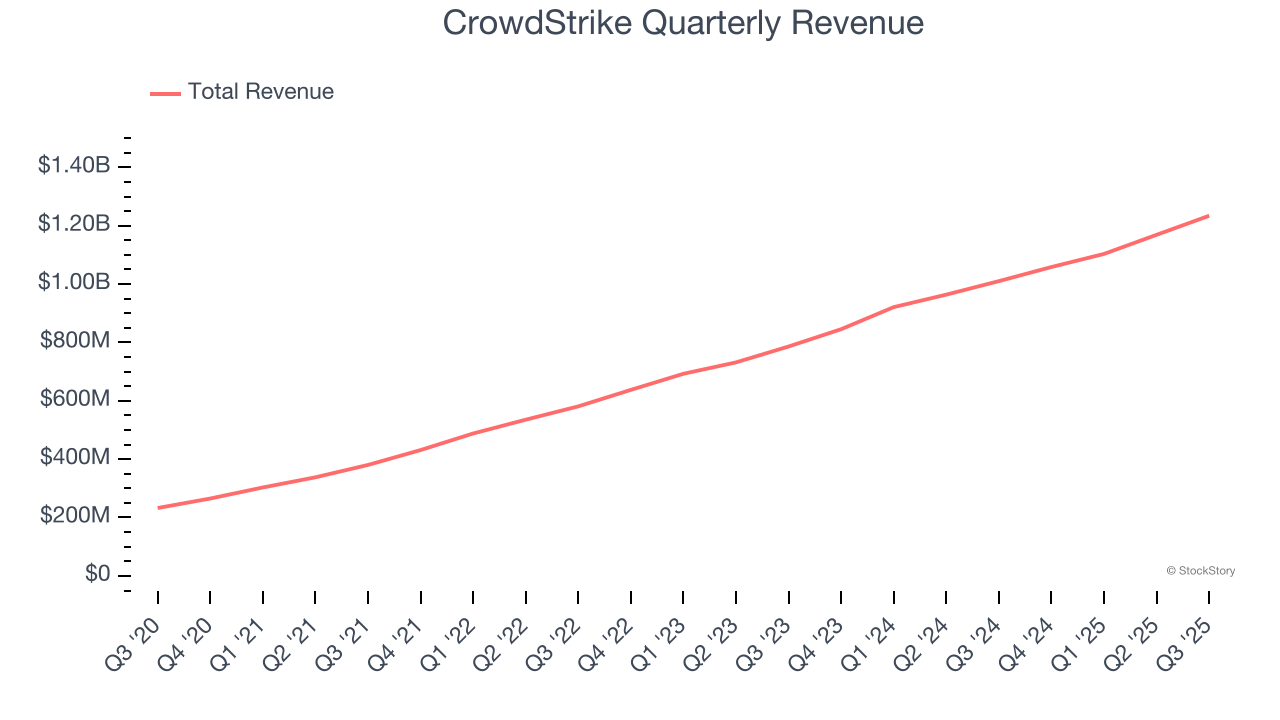

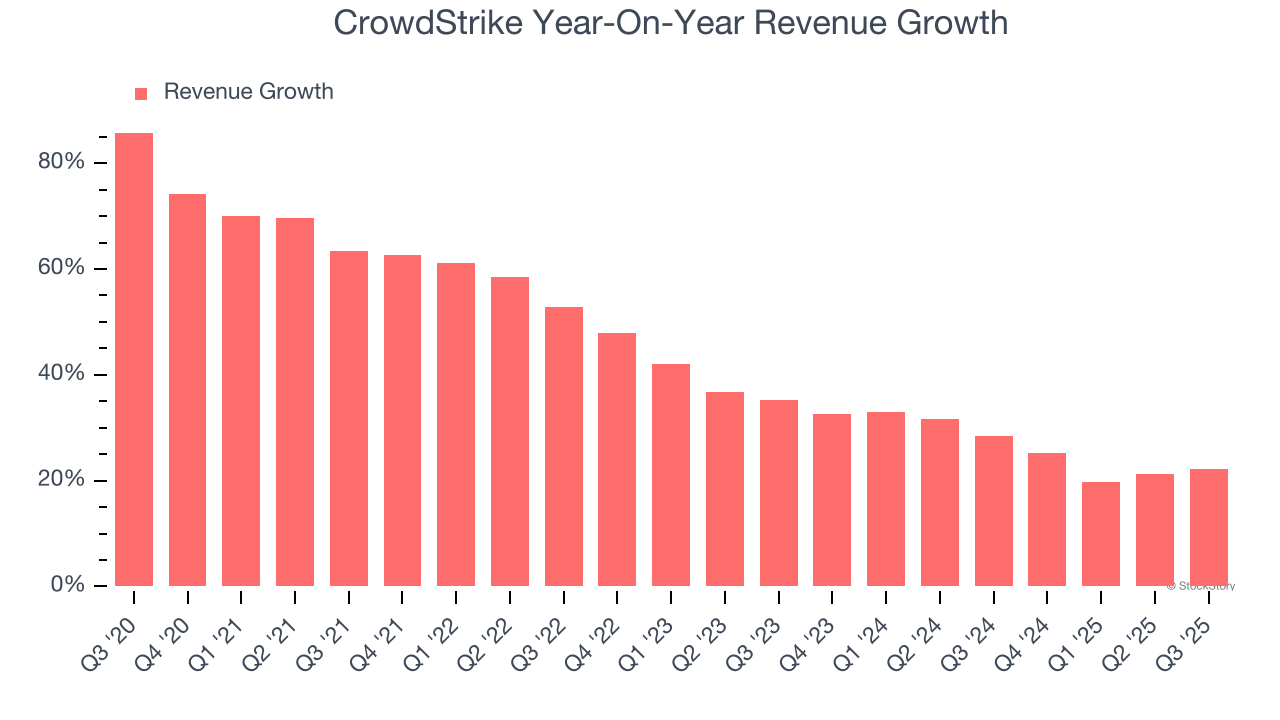

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, CrowdStrike’s sales grew at an incredible 43.1% compounded annual growth rate over the last five years. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. CrowdStrike’s annualized revenue growth of 26.6% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, CrowdStrike reported robust year-on-year revenue growth of 22.2%, and its $1.23 billion of revenue topped Wall Street estimates by 1.6%. Company management is currently guiding for a 22.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 21.5% over the next 12 months, a deceleration versus the last two years. Still, this projection is noteworthy and suggests the market is forecasting success for its products and services.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

CrowdStrike’s ARR punched in at $4.92 billion in Q3, and over the last four quarters, its growth was impressive as it averaged 22% year-on-year increases. This performance aligned with its total sales growth and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes CrowdStrike a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

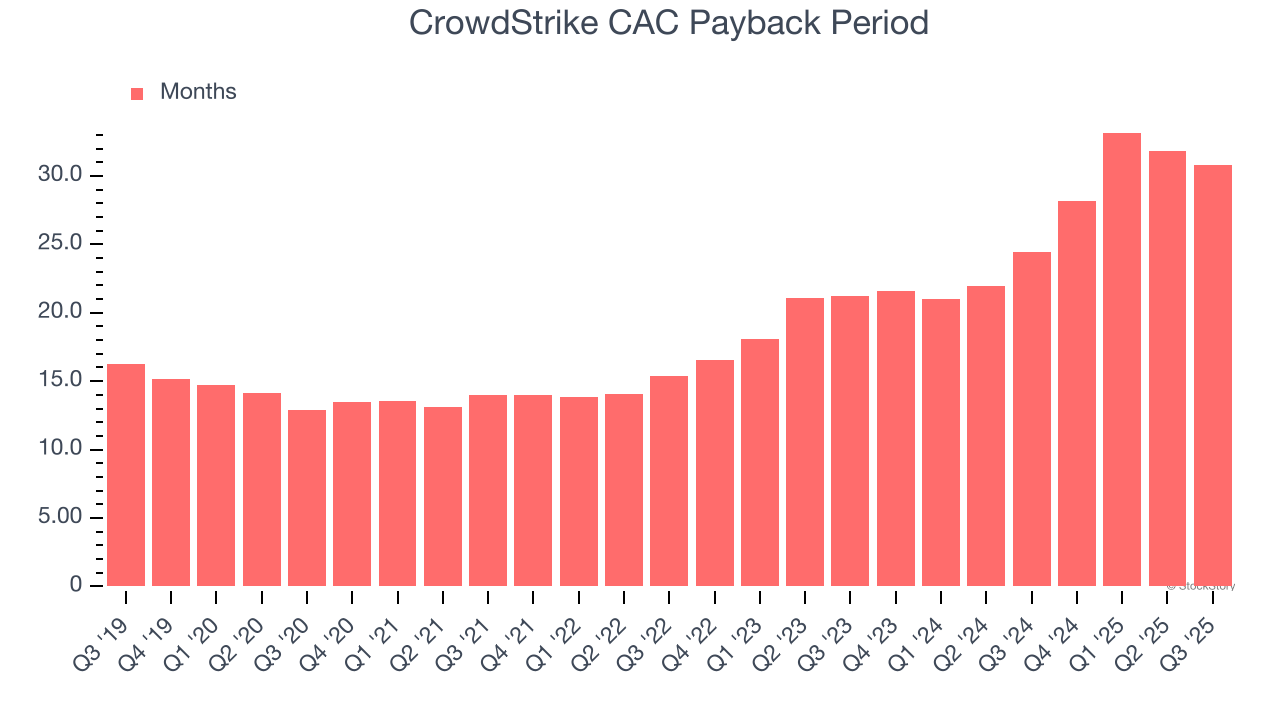

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

CrowdStrike is quite efficient at acquiring new customers, and its CAC payback period checked in at 30.8 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a strong brand reputation, giving it more resources pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

Key Takeaways from CrowdStrike’s Q3 Results

It was encouraging to see CrowdStrike’s EPS guidance for next quarter beat analysts’ expectations. We were also glad its full-year EPS guidance slightly exceeded Wall Street’s estimates. Overall, this print had some key positives. The stock remained flat at $514.05 immediately after reporting.

So do we think CrowdStrike is an attractive buy at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.