Over the past six months, Remitly’s shares (currently trading at $19.31) have posted a disappointing 11.1% loss while the S&P 500 was down 1.6%. This may have investors wondering how to approach the situation.

Given the weaker price action, is now an opportune time to buy RELY? Find out in our full research report, it’s free.

Why Is Remitly a Good Business?

With Amazon founder Jeff Bezos as an early investor, Remitly (NASDAQ:RELY) is an online platform that enables consumers to safely and quickly send money globally.

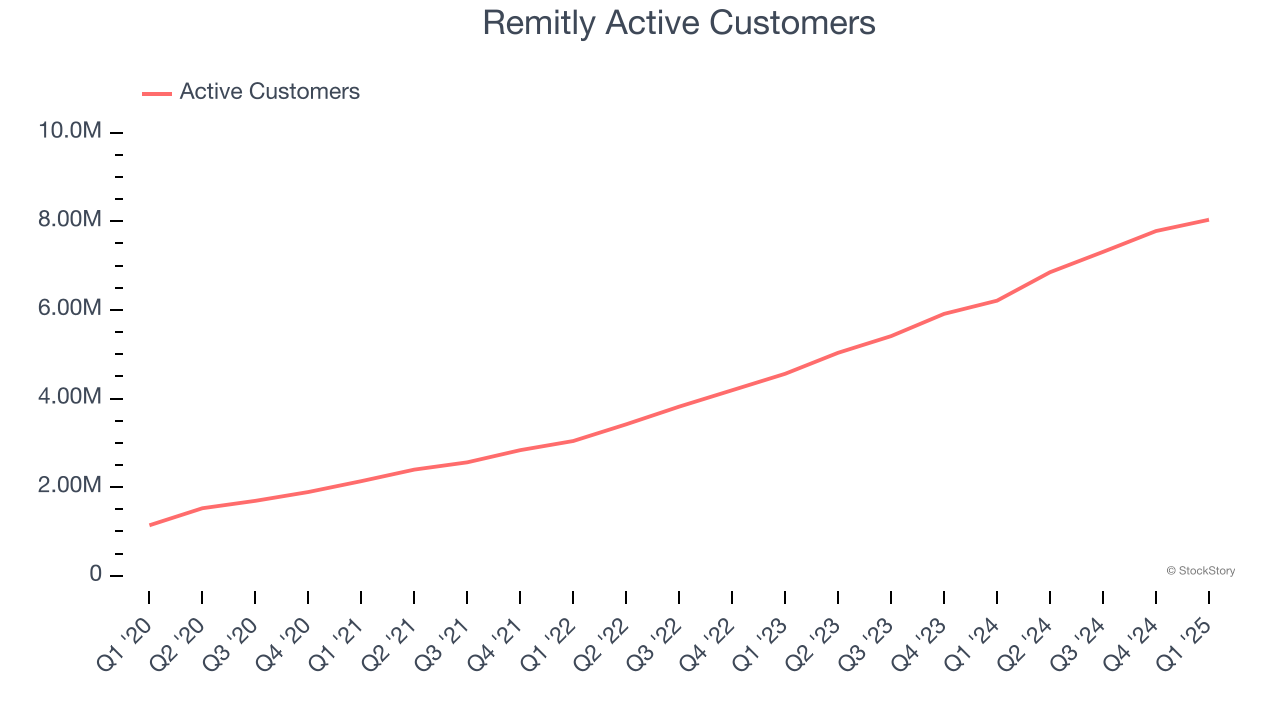

1. Active Customers Skyrocket, Fueling Growth Opportunities

As a fintech company, Remitly generates revenue growth by increasing both the number of users on its platform and the number of transactions they execute.

Over the last two years, Remitly’s active customers, a key performance metric for the company, increased by 37.3% annually to 8.04 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

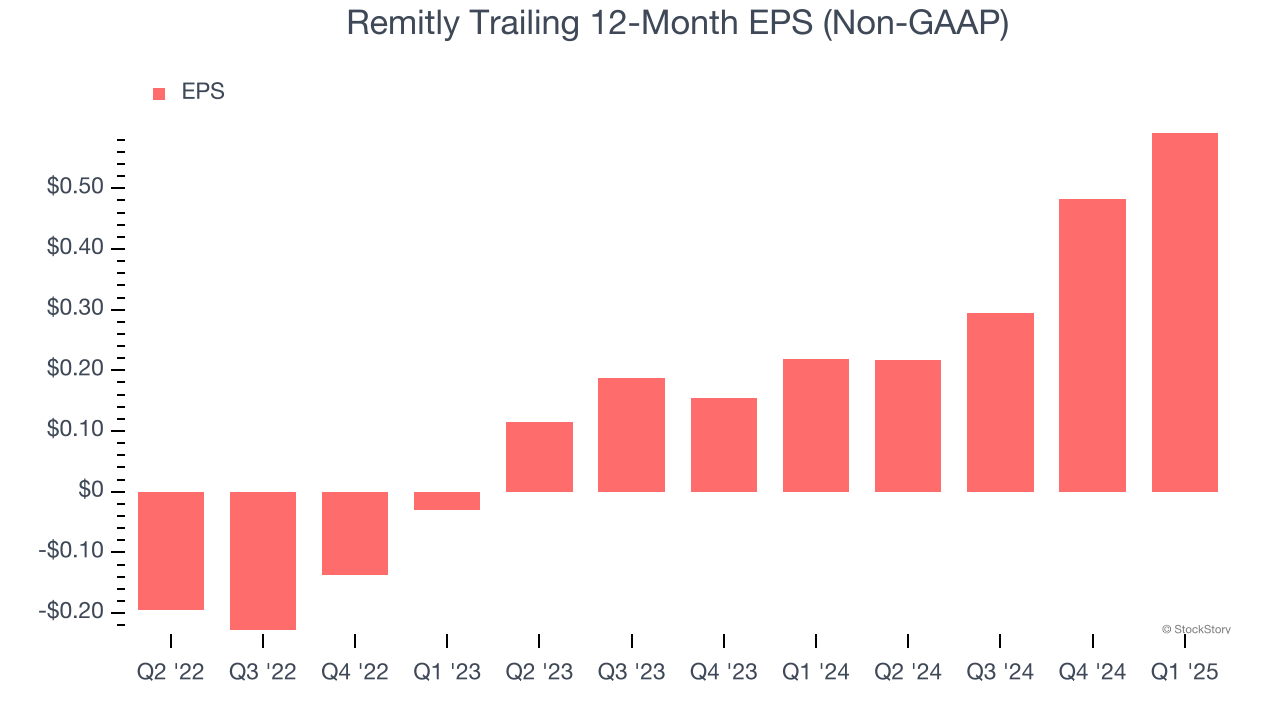

2. Outstanding Long-Term EPS Growth

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Remitly’s full-year EPS flipped from negative to positive over the last three years. This is a good sign and shows it’s at an inflection point.

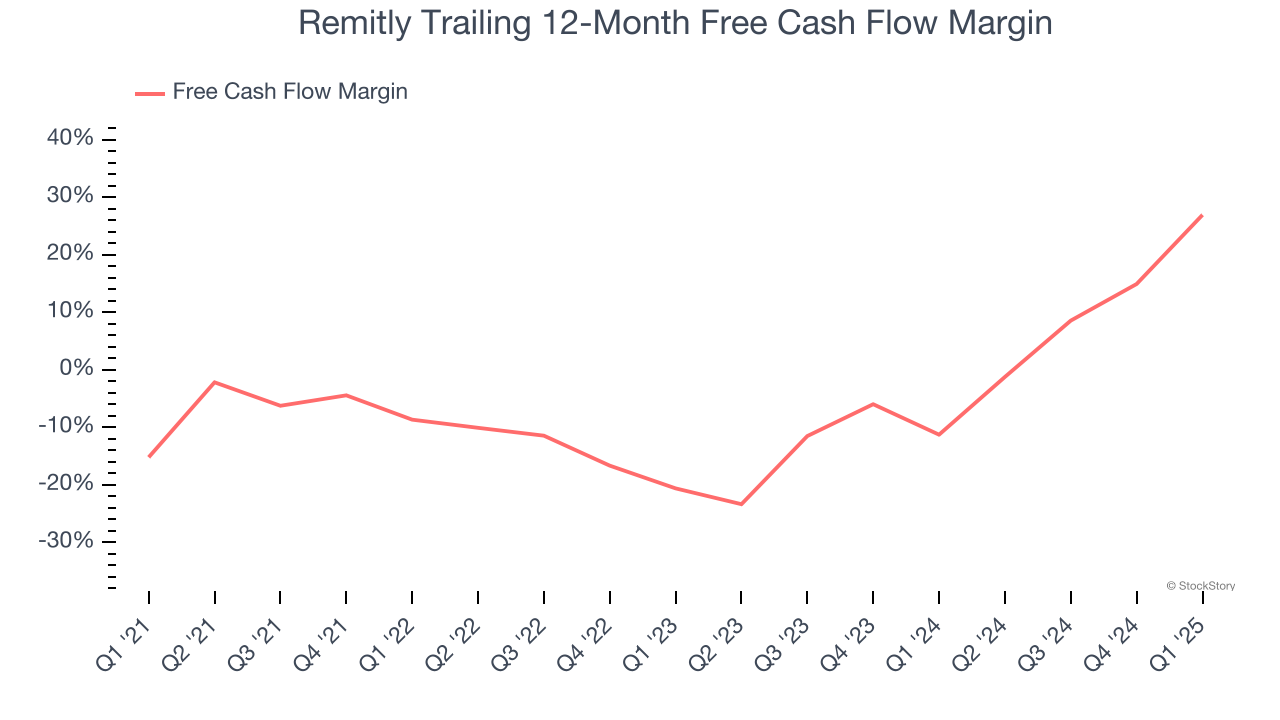

3. Increasing Free Cash Flow Margin Juices Financials

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Remitly’s margin expanded by 35.6 percentage points over the last few years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability. Remitly’s free cash flow margin for the trailing 12 months was 26.9%.

Final Judgment

These are just a few reasons Remitly is a rock-solid business worth owning. With the recent decline, the stock trades at 19.5× forward EV/EBITDA (or $19.31 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Remitly

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.