Recent Articles from Talk Markets

TalkMarkets is a dynamic financial media company headquartered in Highland Park, New Jersey, dedicated to revolutionizing the way users engage with financial content. Founded in 2012, the company offers a unique, web-based platform that delivers personalized investment news, market analysis, and educational resources tailored to each user's interests and investment sophistication.

Website: https://www.talkmarkets.com

Via Talk Markets · February 3, 2026

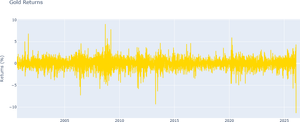

The gold market continues to be one that a lot of people will be watching closely.

Via Talk Markets · February 3, 2026

Dividend paying stocks in the U.S. stock market got off to an unexpectedly strong start in January 2026.

Via Talk Markets · February 3, 2026

Friday, January 30, 2026, will go down as a landmark date in the gold and silver markets.

Via Talk Markets · February 3, 2026

Tighter credit conditions for businesses and stagnant demand for loans related to fixed investment indicate that the expected improvement in eurozone investment is still primarily driven by public spending.

Via Talk Markets · February 3, 2026

Last week's jitters look short-lived on metals... macro and earnings dominate.

Via Talk Markets · February 3, 2026

The Pound Sterling trades cautiously ahead of the BoE policy announcement on Thursday.

Via Talk Markets · February 3, 2026

Asian markets bounced back strongly after experiencing their steepest decline in over two months.

Via Talk Markets · February 3, 2026

The sense of anxiety that hung over the capital markets eased today.

Via Talk Markets · February 3, 2026

EUR/USD steadied at 1.1803 on Tuesday after a strong two-day fall. Support came from strong US macro data and the Fed's revised monetary policy expectations.

Via Talk Markets · February 3, 2026

Debunking rumors and providing the facts as reported regarding the Tesla, XAI, SpaceX investment, merger, or other.

Via Talk Markets · February 3, 2026

Merck, PepsiCo, and Eaton Corporation have unveiled their earnings for the fourth quarter of 2025, showcasing their performance against market expectations.

Via Talk Markets · February 3, 2026

The market closed with an elongated price structure, recovering much of the previous week’s decline with strong bullish momentum.

Via Talk Markets · February 3, 2026

EUR/USD picks up from 1.1775 but is failing to find acceptance above 1.1820.

Via Talk Markets · February 3, 2026

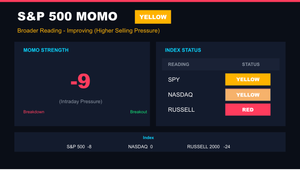

Bullish momentum holds as indices rotate off hourly lows. With JOLTS and jobs data delayed by a government shutdown, focus shifts to a

Via Talk Markets · February 2, 2026

The metal market looked to erase some gains from the recent sell-off as Gold aims for the $5k area.

Via Talk Markets · February 3, 2026

There is something interesting happening beneath the surface in the market right now.

Via Talk Markets · February 3, 2026

DAX rebounds as metals recover and Palantir eases AI fears. Oil falls amid de-escalating geopolitical tensions and a stronger USD.

Via Talk Markets · February 3, 2026

The US natural gas prices plummeted by 21% to $3.42 per MMBtu, completely erasing Friday’s 11% gain.

Via Talk Markets · February 3, 2026

The cryptocurrency market has slightly recovered following its bearish performance over the weekend.

Via Talk Markets · February 3, 2026

For the fifth time in a row, Rivian appears to have completely faked out the bulls.

Via Talk Markets · February 2, 2026

Monthly dividend stocks are securities that pay a dividend every month instead of quarterly or annually.

Via Talk Markets · February 2, 2026

Rice was higher and trends are up as prices have moved out of the sideways bottoming range on the daily and weekly charts.

Via Talk Markets · February 2, 2026

The latest US government shutdown looks to provide yet another bout of disruption to the economic calendar for traders and investors alike, with today’s JOLTS job openings release being postponed.

Via Talk Markets · February 3, 2026

Silver is dropping further, with talk of fraud involving a major Chinese buyer adding to the sense that a speculative bubble may be deflating, raising concerns about how much more downside silver could see in the near term.

Via Talk Markets · February 3, 2026

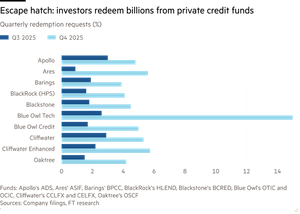

Private credit funds were all the rage in 2024 and 2025 as institutional and high-net-worth retail investors sought more risk and higher returns.

Via Talk Markets · February 3, 2026

Indian share markets are trading higher with the Sensex trading 1,992 points higher, and the Nifty is trading 612 points higher.

Via Talk Markets · February 3, 2026

Bitcoin has been breaking to new lows and underperforming other risky assets, but the bounce at the 1-year low price may signify the start of a bullish double bottom chart pattern.

Via Talk Markets · February 3, 2026

Markets open with AUD lifted by a surprise RBA hike, Japan calming yen jitters, and a Trump–Modi trade reset, while FX shows fragile US Dollar strength ahead of key US data.

Via Talk Markets · February 3, 2026

The S&P advanced to a fresh peak before running into resistance at the psychological 7000 level.

Via Talk Markets · February 3, 2026

USD found more support yesterday before coming under mild pressure overnight.

Via Talk Markets · February 3, 2026

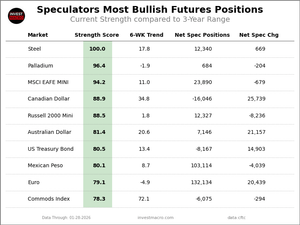

This weekly Extreme Positions report highlights the Most Bullish and Most Bearish Positions for the speculator category. Extreme positioning in these markets can foreshadow strong moves in the underlying market.

Via Talk Markets · February 3, 2026

Every major semiconductor end‑market segment turned positive in January for the first time in two years, but not equally so.

Via Talk Markets · February 3, 2026

Ira Epstein covers the recent developments in the metal markets, noting the unwinding of a parabolic move, particularly in gold, and the subsequent volatility that persists with significant price increases in gold, silver, and platinum

Via Talk Markets · February 3, 2026

The Australian dollar is rebounding strongly after the RBA raised interest rates, reinforcing the broader bullish trend and supporting the ongoing Elliott Wave impulse structure.

Via Talk Markets · February 3, 2026

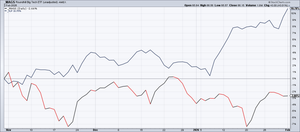

The collapse in silver and gold prices, along with the declines in cryptocurrencies, could be precursors to major sell-offs in stocks and bonds.

Via Talk Markets · February 3, 2026

AMD’s stock soared +15% in early 2026, gaining over +100% annually as an AI chip rival to Nvidia. Driven by accelerator demand and server share, all eyes are on Q4 results tonight, Feb 3, to see if the buy/hold/profit rally persists.

Via Talk Markets · February 3, 2026

The EUR/GBP pair trades vulnerably near the five-month low of 0.8620 during the early European trading session on Tuesday.

Via Talk Markets · February 3, 2026

Concerning post-earnings reactions, Meta Platforms shares popped following its release, whereas Microsoft faced one of its worst days in years.

Via Talk Markets · February 3, 2026

The USD/CHF pair loses traction to near 0.7780 during the early European session on Tuesday.

Via Talk Markets · February 3, 2026

Markets bounced back from a tough trading week last week. We even started this first trading session of the week in the red, but quickly reversed course.

Via Talk Markets · February 2, 2026

Technical analysis shows SanDisk stock breaking through long-term resistance, fueled by a massive post-earnings volume surge that has positioned it as a primary leader in the tech sector's recovery.

Via Talk Markets · February 2, 2026

After a heavy sell-off in commodity markets, most markets are steadier in early morning trading today, while precious metals are recouping some of their recent losses

Via Talk Markets · February 2, 2026

In this video, Ira Epstein discusses the current state of the financial markets on February 2nd, 2026, noting a recovery in the stock market and stability in energy, bonds, and notes.

Via Talk Markets · February 2, 2026

The Australian Dollar gains ground against the US Dollar on Tuesday ahead of the interest rate decision by the Reserve Bank of Australia due later in the day.

Via Talk Markets · February 2, 2026

The current Tobin’s Q ratio is at an all time high of 1.926.

Via Talk Markets · February 2, 2026

As Bitcoin and metals drain, a violent stock market correction is predicted. Cash levels raised to 65%.

Via Talk Markets · February 2, 2026

West Texas Intermediate US Crude Oil prices struggle to capitalize on the previous day's modest bounce from the $61.20 area, or a one-week trough, and attract some sellers for the second straight day on Tuesday.

Via Talk Markets · February 2, 2026

Most monthly dividend stocks are REITs, but investors can still find plenty of monthly dividend stocks that are not REITs. This article will discuss 3 top non-REIT monthly dividend stocks.

Via Talk Markets · February 2, 2026

After an historic sell-off in the precious metals on Friday, despite a move higher during the Sunday night open in the Far East, the sell-off has continued again in New York today.

Via Talk Markets · February 2, 2026

The USD/JPY pair attracts some buyers to around 155.55 during the early Asian session on Tuesday.

Via Talk Markets · February 2, 2026

Citizen’s has declared and paid variable quarterly dividends since October 1993. The February, 2026 Q dividend of $0.28 suggests $1.12 annual dividend for the coming year.

Via Talk Markets · February 2, 2026

A good start to the week has left indices nicely positioned to kick on with volume rising in accumulation.

Via Talk Markets · February 2, 2026

EUR/USD extends losses as last week’s metals sell-off fuels safe-haven flows into the U.S. Dollar.

Via Talk Markets · February 2, 2026

The S&P 500 finished the day higher by a little more than 50 basis points.

Via Talk Markets · February 2, 2026

The S&P 500 returned 17% last year. But measured against gold, you actually went backwards.

Via Talk Markets · February 2, 2026

GBP/USD eased to 1.3646 on Monday, retreating from the August 2021 high of 1.3847 touched last week as markets position ahead of Thursday's BoE decision.

Via Talk Markets · February 2, 2026

The Dollar gained back a little more into the 97 handle. Gold and silver could not sustain a rebound but recovered well from their lows.

Via Talk Markets · February 2, 2026

Precious metal prices fall as much as 29%.

Via Talk Markets · February 2, 2026

Building Tier III data centers—the kind powerful enough to support AI—can take years. This is precisely where Bitcoin miners enter the picture.

Via Talk Markets · February 2, 2026

Silver falls more than 5% as improved US data boosts risk appetite and weighs on safe-haven demand.

Via Talk Markets · February 2, 2026

The IMF estimates for 2026 show no signs of recession. However, the global economy remains in a period of poor growth, high debt, persistent inflation and low productivity.

Via Talk Markets · February 2, 2026

Wall Street set gold, silver, and Bitcoin losses aside to kick off February, with the Dow tacking on 515 points, while the S&P 500 and Nasdaq settled firmly higher as well.

Via Talk Markets · February 2, 2026

Nearly a month of gains in both precious metals were wiped out in a single trading session.

Via Talk Markets · February 2, 2026

Microsoft Corp stock looks cheap here, despite the market's concerns about its free cash flow (FCF). One play for value investors is to sell short at-the-money and out-of-the-money put options with one-month expiration periods.

Via Talk Markets · February 2, 2026

In recent days, the spread between the price of paper silver in New York and the price of physical silver in other markets has reached historic premium levels, revealing extreme pressure on the actual supply.

Via Talk Markets · February 2, 2026

PayPal is scheduled to report results for its fourth fiscal quarter before the market opens on February 3.

Via Talk Markets · February 2, 2026

While we are seeing a technical bounce, the danger is far from over.

Via Talk Markets · February 2, 2026

Bitcoin ETFs face major losses as $2.8B in outflows hit over two weeks, with average purchases now underwater due to market drop.

Via Talk Markets · February 2, 2026

We are starting to see the beginnings of deglobalization: Countries are increasingly at odds with each other. There is wider disparity among political parties.

Via Talk Markets · February 2, 2026

Bitcoin has been ensnared in a brutal crypto winter since soaring to a peak above $126,000 in early October.

Via Talk Markets · February 2, 2026

In the coming week, we will get a dense run of US macro releases, with the January jobs report set to dominate attention on Friday. We also have the ISM surveys, consumer sentiment and the latest Treasury’s quarterly refunding details.

Via Talk Markets · February 2, 2026

Manufacturing expands for only the 2nd time in 50 months.

Via Talk Markets · February 2, 2026

The glittering rally that defined the start of the year for silver has hit a sudden and sharp wall of resistance.

Via Talk Markets · February 2, 2026