Deere & Co (DE)

602.92

+4.81 (0.80%)

NYSE · Last Trade: Feb 16th, 8:41 PM EST

NEW YORK — In a resounding signal that the American industrial heartland has finally shaken off its post-pandemic lethargy, the U.S. manufacturing sector roared back into expansion territory in January 2026. The Institute for Supply Management (ISM) reported on February 2nd that its Manufacturing PMI rose to 52.6 last

Via MarketMinute · February 16, 2026

The U.S. Department of Agriculture (USDA) sent a wave of relief through the agricultural sector this week with the release of its February 2026 World Agricultural Supply and Demand Estimates (WASDE) report. Defying expectations of a mounting supply glut following last year’s historic production, the agency slashed projected

Via MarketMinute · February 16, 2026

Soybean futures have experienced a dramatic 60-cent rally over the past two weeks, as market optimism builds around a potential breakthrough in US-China trade relations. Reports circulating in Washington and Beijing suggest that President Trump and President Xi Jinping are finalizing plans for a high-stakes summit in April 2026. The

Via MarketMinute · February 16, 2026

The stocks featured in this article have all approached their 52-week highs.

When these price levels hit, it typically signals strong business execution, positive market sentiment, or significant industry tailwinds.

Via StockStory · February 15, 2026

Even if they go mostly unnoticed, industrial businesses are the backbone of our country. Their momentum is also rising as lower interest rates have incentivized higher capital spending.

As a result, the industry has posted a 21.9% gain over the past six months, beating the S&P 500 by 16 percentage points.

Via StockStory · February 15, 2026

Construction and farm equipment makers are benefiting from strong spending.

Via The Motley Fool · February 12, 2026

As of February 12, 2026, Caterpillar Inc. (NYSE: CAT) stands as a formidable bellwether for the global economy, transitioning from its centenary year into a new era of autonomous heavy machinery and energy transition infrastructure. Often referred to simply as "Cat," the company is the world’s leading manufacturer of construction and mining equipment, diesel and [...]

Via Finterra · February 12, 2026

The S&P 500 Index retreated further from its historic peaks on Wednesday, closing at 6,914.75, a decline of 0.39% for the session. This pullback marks a significant cooling period for a market that only weeks ago, on January 28, 2026, celebrated a record-shattering high of 7,

Via MarketMinute · February 11, 2026

The American wheat market faced a wave of selling pressure this week following the release of the U.S. Department of Agriculture’s (USDA) February World Agricultural Supply and Demand Estimates (WASDE) report. The report, a critical barometer for global food commodities, stunned traders by upwardly revising U.S. wheat

Via MarketMinute · February 11, 2026

In a surprising turn of events for the global agricultural markets, the U.S. Department of Agriculture (USDA) released its February 2026 World Agricultural Supply and Demand Estimates (WASDE) report, delivering a significant boost to the American corn outlook. Defying a prevailing market consensus that expected a neutral to slightly

Via MarketMinute · February 11, 2026

Agriculture products company SiteOne Landscape Supply (NYSE:SITE) missed Wall Street’s revenue expectations in Q4 CY2025 as sales rose 3.2% year on year to $1.05 billion. Its GAAP loss of $0.20 per share was 35% above analysts’ consensus estimates.

Via StockStory · February 11, 2026

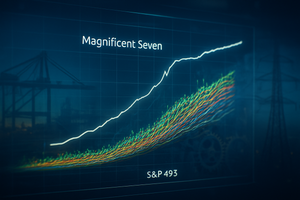

As of February 10, 2026, the long-standing "two-speed" economy that defined the post-pandemic era has finally reached a historic turning point. For years, a handful of mega-cap technology titans—the "Magnificent Seven"—carried the weight of the entire U.S. stock market on their shoulders, while the remaining 493 companies

Via MarketMinute · February 10, 2026

Via MarketBeat · February 9, 2026

The U.S. industrial sector has finally signaled a definitive end to its prolonged period of stagnation, with the Institute for Supply Management (ISM) reporting that the Manufacturing PMI surged to 52.6% in January 2026. This reading marks the first significant expansion for the sector in over a year,

Via MarketMinute · February 9, 2026

In a stunning reversal of a year-long industrial malaise, the U.S. manufacturing sector roared back to life this week as the Institute for Supply Management (ISM) released its latest Purchasing Managers' Index (PMI) data. The report, made public on February 6, 2026, showed the manufacturing PMI climbing to a

Via MarketMinute · February 6, 2026

A number of stocks jumped in the afternoon session after the broader market rebounded from a tech-driven sell-off, with investors taking the opportunity to buy stocks at lower prices.

Via StockStory · February 6, 2026

As of early February 2026, the long-predicted "Great Rotation" in the financial markets has moved from a theoretical forecast to a dominant reality. After years of a top-heavy market driven by a handful of technology titans, the tide has finally turned. The first five weeks of 2026 have seen the

Via MarketMinute · February 6, 2026

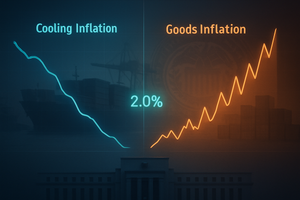

As of February 6, 2026, the American economy finds itself in a precarious balancing act. The "Liberation Day" tariffs, a cornerstone of the current administration’s trade policy, have successfully reshaped supply chains but at a significant cost: "sticky" goods inflation. While services inflation has largely cooled, the persistent rise

Via MarketMinute · February 6, 2026

Via Benzinga · February 6, 2026

The latest Personal Consumption Expenditures (PCE) price index data has revealed a significant shift in the U.S. inflationary landscape, presenting a complex puzzle for the Federal Reserve. As of early February 2026, the data shows a stark divergence: while the services sector—the primary engine of post-pandemic inflation—is

Via MarketMinute · February 6, 2026

Agricultural markets are entering a period of profound uncertainty as a confluence of surging input costs, volatile weather patterns, and shifting geopolitical alliances threaten to destabilize global food security. Despite a period of relative stabilization throughout 2025, early data from February 2026 suggests the "calm" is rapidly evaporating. According to

Via MarketMinute · February 6, 2026

As of February 6, 2026, the agricultural sector finds itself at the center of a high-stakes tug-of-war between digital diplomacy and physical market fundamentals. This week, the soybean market transformed into a volatile arena where a single social media post from President Donald Trump managed to erase weeks of bearish

Via MarketMinute · February 6, 2026

The United States agricultural sector is witnessing a historic resurgence in international demand, with corn export volumes skyrocketing by 33% over the past year. Driven by a record-breaking 17.02 billion bushel harvest in late 2025, American growers are successfully reclaiming global market share, navigating a complex landscape of shifting

Via MarketMinute · February 5, 2026