Intercontinental Exchange (ICE)

169.00

+0.71 (0.42%)

NYSE · Last Trade: Feb 7th, 1:11 PM EST

Detailed Quote

| Previous Close | 168.29 |

|---|---|

| Open | 169.85 |

| Bid | 164.75 |

| Ask | 171.50 |

| Day's Range | 166.81 - 173.86 |

| 52 Week Range | 143.17 - 189.35 |

| Volume | 3,539,794 |

| Market Cap | 96.33B |

| PE Ratio (TTM) | 29.29 |

| EPS (TTM) | 5.8 |

| Dividend & Yield | 1.920 (1.14%) |

| 1 Month Average Volume | 3,900,476 |

Chart

About Intercontinental Exchange (ICE)

Intercontinental Exchange is a leading operator of global exchanges and clearinghouses, focused on facilitating efficient trading and risk management across a range of asset classes. The company provides a platform for the trading of commodities, financial instruments, and various derivatives, thereby helping to improve price transparency and market access for its clients. Additionally, ICE offers technology solutions and data services to enhance trading and investment strategies, while also playing a vital role in supporting regulatory requirements within the financial markets. Its diverse portfolio includes well-known exchanges and innovative clearing services that cater to both retail and institutional participants. Read More

News & Press Releases

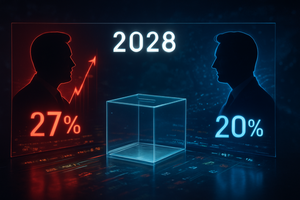

While the dust of the 2024 election has long since settled, the gaze of the political and financial worlds has already shifted toward the next horizon. As of February 7, 2026, prediction markets for the 2028 Democratic Nominee have reached an unprecedented level of early activity. On Kalshi, the premier regulated event contract exchange, the [...]

Via PredictStreet · February 7, 2026

The landscape of global finance shifted permanently this winter as the Intercontinental Exchange (NYSE: ICE) finalized a staggering $2 billion strategic investment into Polymarket. For years, prediction markets were viewed as the "Wild West" of decentralized finance—a niche playground for crypto-natives and political junkies. However, with the backing of the world’s most powerful exchange operator, [...]

Via PredictStreet · February 6, 2026

As of February 6, 2026, the intersection of high finance and political power has reached a new frontier. The Trump family, led by Donald Trump Jr., has successfully pivoted from the political arena into the bedrock of the global "Information Finance" (InfoFi) movement. With strategic advisory roles at the industry’s two largest platforms, Kalshi and [...]

Via PredictStreet · February 6, 2026

Intercontinental Exchange Inc (NYSE:ICE) Edges Past Q4 2025 Estimates, Provides Measured 2026 Outlookchartmill.com

Via Chartmill · February 5, 2026

As of February 6, 2026, the prediction market landscape has officially transitioned from a niche corner of the internet into a high-stakes battleground for global financial supremacy. Dubbed "The Great Prediction War of 2026," the industry is currently witnessing an unprecedented clash between the decentralized heavyweight Polymarket and the federally regulated Kalshi. At the center [...]

Via PredictStreet · February 6, 2026

Intercontinental Exchange, Inc. (NYSE:ICE), a leading global provider of technology and data and home to the most liquid energy markets in the world, today announced that January 2026 saw record trading activity in ICE’s Midland WTI (HOU) and Canadian crude oil markets as customers manage the impact on oil flows from the return of Venezuela as an oil exporter.

By Intercontinental Exchange · Via Business Wire · February 6, 2026

Global market infrastructure company Intercontinental Exchange (NYSE:ICE) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 7.8% year on year to $2.50 billion. Its non-GAAP profit of $1.71 per share was 2.2% above analysts’ consensus estimates.

Via StockStory · February 6, 2026

In a move that signals the complete integration of digital assets into the global financial architecture, CME Group (NASDAQ: CME) has announced the expansion of its cryptocurrency derivatives suite to include Cardano (ADA), Chainlink (LINK), and Polkadot (DOT). The launch, set to take place on February 9, 2026, is paired

Via MarketMinute · February 5, 2026

While the dust of the 2024 election cycle has barely settled, the financial world is already placing its bets on the next battle for the White House. As of February 2026, prediction markets—the once-niche platforms that successfully forecasted the 2024 outcome with surgical precision—are signaling a clear trajectory for the 2028 U.S. Presidential Election. Vice [...]

Via PredictStreet · February 5, 2026

As the Federal Reserve's March 2026 meeting approaches, a striking divergence has emerged between traditional financial instruments and the burgeoning world of "Information Finance." On Kalshi, the federally regulated prediction market, traders are increasingly convinced that the central bank will pivot toward easing. Currently, 64% of participants on the platform are betting on a 25-basis-point [...]

Via PredictStreet · February 5, 2026

The global financial landscape has shifted into a new era of "Information Finance," or InfoFi, where the most valuable commodity is not gold or oil, but the "truth." As of February 5, 2026, the battle for dominance in this sector has narrowed down to two titans: Polymarket, the decentralized, crypto-native pioneer, and Kalshi, the regulated, [...]

Via PredictStreet · February 5, 2026

The prediction market industry has officially shed its label as a niche corner of the internet for political junkies and sports bettors. As of early February 2026, the sector is celebrating a watershed moment: total trading volume surpassed a staggering $45 billion in 2025, a nearly five-fold increase from the previous year. This momentum shows [...]

Via PredictStreet · February 5, 2026

ICE Q4 2025 Earnings Call Transcript

Via The Motley Fool · February 5, 2026

Global market infrastructure company Intercontinental Exchange (NYSE:ICE) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 35.3% year on year to $3.14 billion. Its non-GAAP profit of $1.71 per share was 2.2% above analysts’ consensus estimates.

Via StockStory · February 5, 2026

Intercontinental Exchange (NYSE: ICE), a leading global provider of technology and data, announced board authorization of its first quarter 2026 dividend of $0.52 per share, up 8% from its previous $0.48 per share quarterly dividend in 2025.

By Intercontinental Exchange · Via Business Wire · February 5, 2026

Intercontinental Exchange (NYSE: ICE):

By Intercontinental Exchange · Via Business Wire · February 5, 2026

Intercontinental Exchange, Inc. (NYSE:ICE), a leading global provider of technology and data, today reported January 2026 trading volume and related revenue statistics, which can be viewed on the company’s investor relations website at https://ir.theice.com/ir-resources/supplemental-information in the Monthly Statistics Tracking spreadsheet.

By Intercontinental Exchange · Via Business Wire · February 4, 2026

Global market infrastructure company Intercontinental Exchange (NYSE:ICE) will be reporting earnings this Thursday before market open. Here’s what to expect.

Via StockStory · February 3, 2026

SiteOne Landscape Supply distributes a broad range of landscape products to professional customers across North America.

Via The Motley Fool · February 3, 2026

BellRing Brands markets protein shakes and powders through Premier Protein and Dymatize, serving health-conscious consumers globally.

Via The Motley Fool · February 3, 2026

Serving bookmakers and media worldwide, Sportradar delivers sports data, analytics, and streaming solutions across the betting value chain.

Via The Motley Fool · February 3, 2026

Intercontinental Exchange, Inc. (NYSE: ICE), a leading global provider of technology and data, today announced that the U.S. Securities and Exchange Commission (SEC) has approved its application and rulebook for ICE Clear Credit to expand its current registered Covered Clearing Agency (CCA) designation to add U.S. Treasury clearing. ICE Clear Credit’s U.S. Treasury clearing service is now fully operationally live, providing market participants with welcome competition and the first ever alternative venue for clearing U.S. Treasury securities.

By Intercontinental Exchange · Via Business Wire · February 3, 2026

Intercontinental Exchange, Inc. (NYSE: ICE), a leading global provider of technology and data, today announced that January marked the strongest month for trading activity in its history with a record 245.8 million contracts traded, including a record 199 million futures traded and a record 46.9 million options traded.

By Intercontinental Exchange · Via Business Wire · February 3, 2026

The concept of "Information Finance," or InfoFi, has transitioned from a niche crypto-economic theory into a foundational pillar of global finance and media. As of February 2, 2026, prediction markets are no longer viewed as mere platforms for speculation; they have been repositioned as sophisticated data-transmission mechanisms that assign a market price to the accuracy [...]

Via PredictStreet · February 2, 2026

As the calendar turns to February 2026, the United States is bracing for a political showdown that promises to be as much a financial event as a democratic one. The 2026 U.S. Midterm Elections are already generating unprecedented activity in the prediction market space, with traders pouring billions of dollars into contracts determining the future [...]

Via PredictStreet · February 2, 2026