Lockheed Martin (LMT)

623.58

+14.40 (2.36%)

NYSE · Last Trade: Feb 7th, 6:35 PM EST

Explore how sector focus and portfolio construction set these two dividend ETFs apart for income and growth-oriented investors.

Via The Motley Fool · February 7, 2026

Explore how sector focus and dividend strategy set these two leading ETFs apart for investors seeking income or growth.

Via The Motley Fool · February 7, 2026

As of February 7, 2026, the geopolitical world is fixated on a high-stakes question that has long been whispered in the corridors of power in Tehran: when will the era of Ayatollah Ali Khamenei end? For years, this was the subject of classified intelligence briefs and academic speculation. Today, it is a $17 million market [...]

Via PredictStreet · February 7, 2026

Here's Why Lockheed Martin Surged 31% in Januaryfool.com

Via The Motley Fool · February 4, 2026

As of February 7, 2026, the intersection of high-stakes diplomacy and military posturing has turned the eyes of the world toward the Persian Gulf. Prediction markets are currently pricing in a significant probability of military conflict between the United States and Iran, with the flagship "U.S. strike on Iran" market on Polymarket seeing its cumulative [...]

Via PredictStreet · February 7, 2026

Defense spending around the world is on the rise, and these two companies are looking to be some of the biggest beneficiaries of it.

Via The Motley Fool · February 6, 2026

MUSCAT, Oman — On February 6, 2026, global financial markets pivoted sharply as indirect negotiations between the United States and Iran resumed in Oman, aiming to de-escalate a year of unprecedented military and economic friction. This "Oman Round" of talks comes on the heels of a historic surge in gold prices

Via MarketMinute · February 6, 2026

In a week defined by high-stakes political theater and a brief but disruptive lapse in federal operations, Washington has managed to pull back from the edge of a total collapse—though only partially. On February 3, 2026, a $1.2 trillion appropriations package was signed into law, ending a four-day

Via MarketMinute · February 6, 2026

Global defense spending is accelerating and driving defense stocks dramatically higher.

Via The Motley Fool · February 6, 2026

In a demonstration that signals a paradigm shift in modern warfare, the U.S. Department of Defense (DoD) recently concluded its Scarlet Dragon 26-1 exercise, showcasing an unprecedented level of artificial intelligence integration into the "sensor-to-shooter" kill chain. Held from December 1 to 11, 2025, primarily at Fort Liberty, North Carolina, the exercise proved that a [...]

Via TokenRing AI · February 6, 2026

As of early February 2026, the global financial markets are witnessing a paradigm shift that many analysts are calling the "Security Supercycle." What began as a reactive surge in defense spending following the 2022 invasion of Ukraine has evolved into a structural, multi-decade rearmament phase. This "deterrence economy" has pushed

Via MarketMinute · February 6, 2026

Shares of aerospace and defense company Huntington Ingalls (NYSE:HII)

jumped 5.2% in the morning session after the company reported strong fourth-quarter results that surpassed Wall Street's expectations for both revenue and profit, driven by operational improvements and a positive outlook for 2026.

Via StockStory · February 6, 2026

Shares of bearings manufacturer RBC Bearings (NYSE:RBC) jumped 4.6% in the morning session after the company reported strong fiscal third-quarter results that surpassed analyst expectations and provided an optimistic outlook for the upcoming quarter.

Via StockStory · February 6, 2026

The four-day partial government shutdown that began at midnight on January 30, 2026, has officially come to a close, yet the ripples of the gridlock continue to disturb the waters of Wall Street. While the signing of a short-term funding bill on February 3 restored operations for the Department of

Via MarketMinute · February 6, 2026

In a move that has sent shockwaves through both Silicon Valley and Wall Street, Elon Musk announced on February 2, 2026, the formal merger of his aerospace giant, SpaceX, and his artificial intelligence venture, xAI. The deal values the combined entity at a staggering $1.25 trillion, creating the world’

Via MarketMinute · February 6, 2026

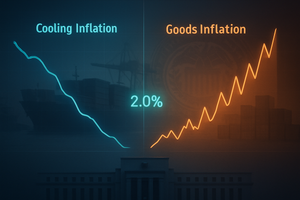

As of February 6, 2026, the American economy finds itself in a precarious balancing act. The "Liberation Day" tariffs, a cornerstone of the current administration’s trade policy, have successfully reshaped supply chains but at a significant cost: "sticky" goods inflation. While services inflation has largely cooled, the persistent rise

Via MarketMinute · February 6, 2026

The latest Personal Consumption Expenditures (PCE) price index data has revealed a significant shift in the U.S. inflationary landscape, presenting a complex puzzle for the Federal Reserve. As of early February 2026, the data shows a stark divergence: while the services sector—the primary engine of post-pandemic inflation—is

Via MarketMinute · February 6, 2026

The specter of a prolonged federal freeze dissipated early this week as President Donald Trump signed a $1.2 trillion spending package into law on February 3, 2026. The move officially ended a four-day partial government shutdown that had paralyzed several federal agencies since the clock struck midnight on January

Via MarketMinute · February 6, 2026

In a historic leap for interplanetary exploration, NASA’s Jet Propulsion Laboratory (JPL) has confirmed the successful completion of the first Martian rover drives planned entirely by an autonomous artificial intelligence agent. Utilizing a specialized iteration of Claude 4.5 from Anthropic, the Perseverance rover navigated a high-risk 456-meter stretch of the Jezero Crater in late 2025, [...]

Via TokenRing AI · February 5, 2026

Shares of industrials products and automation company Regal Rexnord (NYSE:RRX).

jumped 6.7% in the pre-market session after the company reported mixed fourth-quarter results, where a slight earnings beat seemed to overshadow misses on revenue and guidance.

Via StockStory · February 5, 2026

Via Benzinga · February 5, 2026

Date: February 5, 2026 Introduction In the high-stakes arena of aerospace and defense, Mercury Systems (Nasdaq: MRCY) has long occupied a unique and essential niche. Positioned as the critical bridge between commercial silicon innovation and the ruggedized, secure requirements of the modern battlefield, the company was once a darling of the "growth-by-acquisition" era. However, after [...]

Via Finterra · February 5, 2026

Lockheed Martin’s fourth-quarter results were well received by the market, with leadership attributing the outperformance to strong execution across its core defense programs and a surge in demand for advanced technologies. Management cited record delivery numbers for F-35 fighter jets and PAC-3 interceptors, as well as successful deployments of AI-enabled and space-based systems. CEO James Taiclet highlighted the company’s focus on operational execution and stated, “Our mile-long Fort Worth facility enables an F-35 production rate that is five times faster than any other allied fighter currently in production.”

Via StockStory · February 5, 2026

Cathie Wood, ARK Invest purchase Lockheed Martin, AeroVironment, more. Woodward receives target hike on Q4 beat, guidance upgrade.

Via Investor's Business Daily · February 3, 2026

As of February 2, 2026, NASA’s ambitious Dragonfly mission has officially transitioned into Phase D, marking the commencement of the "Iron Bird" integration and testing phase at the Johns Hopkins Applied Physics Laboratory (APL). This pivotal milestone signifies that the mission has moved from the drawing board to the physical assembly of flight hardware. Dragonfly, [...]

Via TokenRing AI · February 2, 2026